In the past 2 weeks, there’s been big news about inflation and seemingly big news about Fed policy. Both are threats to low interest rates, but not just yet, apparently.

After taking last week’s huge inflation numbers in stride (read more…), the bond market moved on to focus on Fed policy this week.

The Federal Reserve (aka, the Fed) is often a source of confusion for consumers when it comes to mortgage rates. The evening news says things like “the Fed kept rates unchanged,” and people assume it has something to do with mortgage rates.

The Fed Funds Rate (the thing the Fed actually decides to hike, cut, or hold steady) has almost nothing to do with the mortgage market. Mortgage rates are infinitely more concerned with the Fed’s bond buying policies.

Movement in the bond market is the foundation of day-to-day mortgage rate changes. Bonds can move for a variety of reasons, but the most reliable and most basic reason is “supply and demand.” By acting as a massive buyer of bonds (including the bonds that directly underlie mortgages), the Fed increases demand relative to supply. Higher demand means higher bond prices, and higher bond prices equate to lower rates, all other things being equal.

In other words, Fed bond buying = lower rates, and they’ve been buying more than anyone for a long time. Ideally, the Fed won’t need to do this forever, but change is scary when it refers to the Fed withdrawing support.

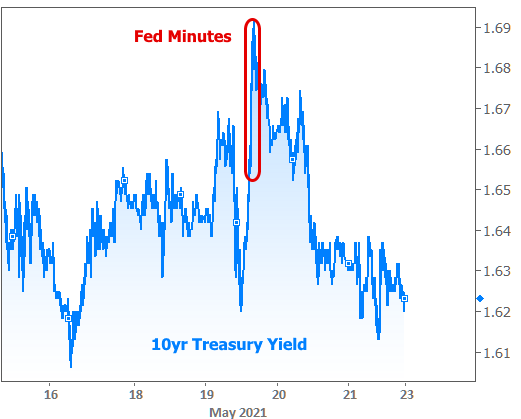

It was this sort of change that sparked the taper tantrum in 2013, which accounted for some of the most abrupt rate spikes in decades. Markets are understandably cautious about a repeat performance, and market participants thought they saw hints about tapering in Wednesday’s Fed meeting minutes (a more detailed account of the meeting that took place 3 weeks ago).

But those comments were nothing like the discussion surrounding tapering in 2013. Back then, multiple Fed members were in agreement, and Bernanke (the Fed Chair at the time) was already on record discussing the conditions for tapering in specific terms.

This time around, the comments relating to tapering simply reiterated those from various Fed speeches in recent weeks. Not only is the Fed far from unanimous on this front, there’s also a lot more uncertainty about when they’ll pull the trigger.

Even then, to say the comments were highly conditional would be an understatement. See for yourself:

“A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

Translation: the Fed isn’t even talking about tapering yet. There are just 4 Fed members who agree they should talk about it in the future if certain things happen. Pretty logical, actually… The market reaction ended up being logical as well: spooked at first, but quickly calming down.

The Fed will need to see several months of strong economic data before any robust discussion of tapering. Even then, the pain of the taper tantrum in 2013 means that traders have been gradually getting in position for this discussion for many months. When the time comes, there will be much less to freak out about–at least as far as Fed bond buying is concerned.

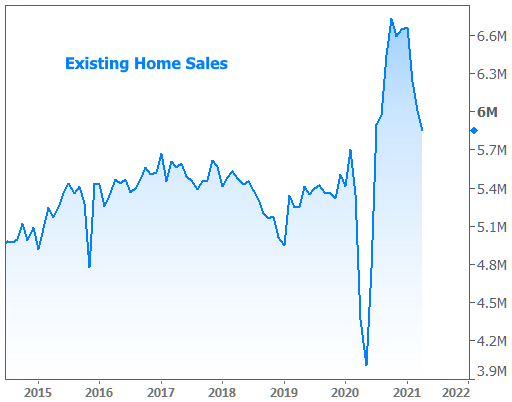

In this week’s economic data, Existing Homes Sales moved lower yet again.

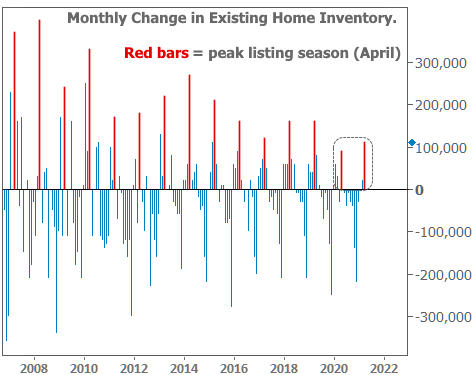

How is it that sales keep declining when we’re hearing so much about a veritable buying frenzy in many local real estate markets? The explanation has been and continues to be one of inventory! The following chart shows the monthly change in existing home inventory. It’s a very seasonal thing, and it always peaks with April’s numbers (reported near the end of May). Each red bar is April. With this week’s report, the past 2 Aprils now stand as the lowest gainers for housing inventory in decades.

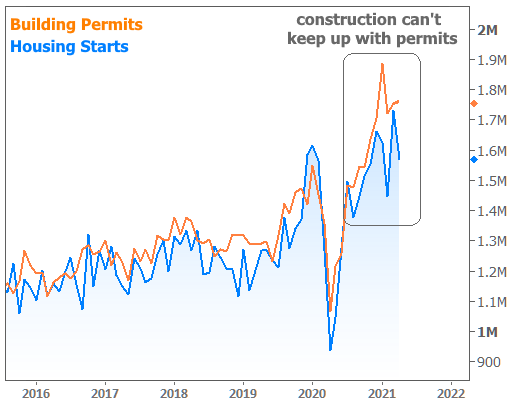

But that’s for existing homes. How about new homes? Well… builders are building as fast as they can. Supply chain disruptions, land availability, labor force issues, and price pressures are causing delays. Construction simply can’t keep up with building permits.