Interest rates can’t seem to catch a break. February was one of only a handful of months in the past 2 decades that resulted in a 0.50% mortgage rate spike. Despite hopes to the contrary, March isn’t off to a great start either. Paradoxically, this rate drama means everything is going according to plan.

Why is that?

Because the “plan,” in this case, is to win the war on the pandemic. That’s a multi-faceted issue, of course, and the war is far from over. But most of the battles have deleterious effects on rates when they’re going well.

At the most basic level, as covid recedes, the economy improves and a strong economy is the quintessential inspiration for rising rates.

Inflation is a closely related concept to general economic growth because more “demand” in the economy results in higher prices, all other things being equal. Inflation is also an enemy of bonds/rates (i.e. higher inflation = higher rates).

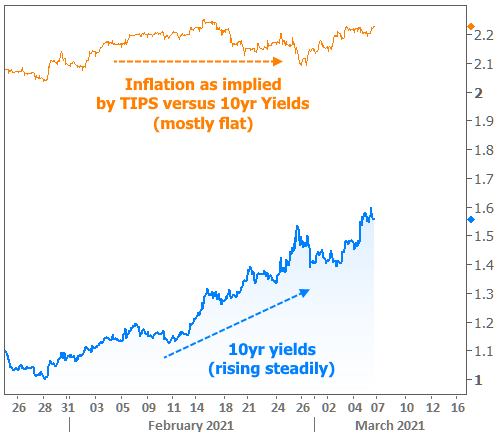

There is a healthy debate right now as to how much inflation is actually driving the recent rate spike. Some give almost all the credit to fears of hyperinflation while others aren’t too concerned. The following chart puts things in context. The orange line shows how traders are actually betting on inflation, moment to moment, and the blue line is actual 10yr Treasury yields. If inflation were the only driver, these lines would be moving up at the same pace.

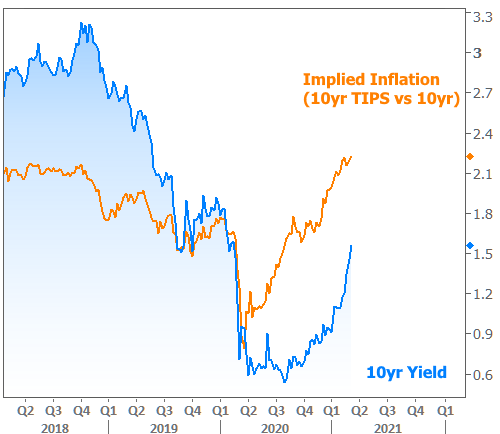

That’s not to say that inflation isn’t a relevant fear for rates. It is certainly contributing to higher rates in the slightly longer run (just not as much in the past month or so). Here’s the same chart with a much wider view:

As far as the Federal Reserve is concerned, any major inflation spike in the near term will be a temporary byproduct of covid-related supply constraints and computational factors. Specifically, “year-over-year” numbers will soon be based on months in 2020 that had extremely low inflation (i.e. compared to April 2020, April 2021 was probably always going to look pretty high).

The Fed will continue to buy Treasuries and Mortgage-Backed Securities (MBS) until they’re confident their goals have been achieved, both in terms of inflation and the labor market. Fed Chair Powell reiterated that commitment yet again in a webcast during the WSJ Jobs Summit on Thursday, but that stance is so well-known that it was of little solace to those on the rising rate bandwagon.

For some reason, some traders began speculating that Powell and the Fed would throw a bone to the bond market after several weeks of rapidly rising rates (i.e. say or do something to bring rates back down a bit). That’s not necessarily farfetched, but the buzz was centered on “Operation Twist“–a past Fed policy that involved selling shorter term bonds and buying an equal amount of longer term bonds. In so doing, the Fed could keep spending the same amount of money while putting more downward pressure on the longer-term rates that benefit consumers.

Just one problem: the Fed has been really clear in saying that’s off the table. It was a possibility in late 2020, but they unanimously shot it down. Several Fed speakers reiterated that decision in recent months. Moreover, in the past few weeks, as rates have been spiking, almost every Fed speaker has made some combination of the following points:

- the rate spike reflects broad economic optimism and progress against the pandemic

- rates at these levels aren’t currently a concern

In other words, rapidly rising rates are a logical byproduct of what’s going on with the economy, covid case counts, and vaccination progress. They’re “good news” even if they’re bad news for fans of low mortgage rates.

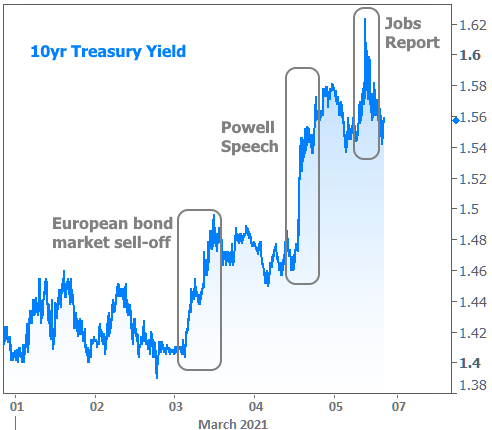

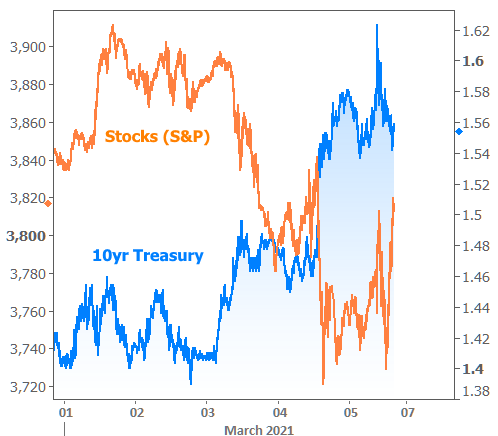

Powell stuck to the same script, and markets had a bit of a fit. The following chart shows the Powell reaction along with the week’s 2 other noticeable rate spikes, one driven by Europe, and the other by a strong jobs report.

Bottom line: rates have been rising for well-understood reasons, even if the pace has been surprising to some. With the Fed basically endorsing the rate spike as evidence of progress, don’t be surprised if the pace can continue to–well… surprise you.

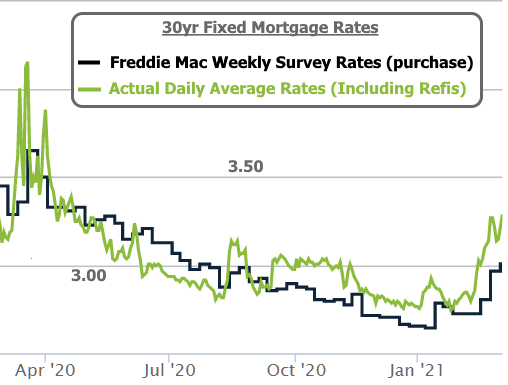

Turning to mortgage rates, specifically, the week ended with 30yr fixed rates right in line with their highest levels in nearly a year. Most mortgage rate headlines won’t mention that because they’re based on Freddie Mac’s weekly survey which has yet to catch up with reality on the front lines (especially for refinance rates, which are a bit higher than purchase rates).

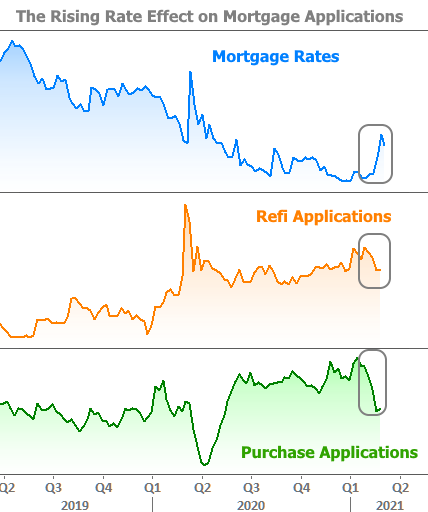

The 2021 rate spike has been around long enough to be taking a visible toll on mortgage applications. Outright levels are still very strong, and there are other factors in play, of course, but the correlation is solid. Notably, the rate spike looks like it had bigger implications for the purchase market, but past precedent suggests an even bigger supply of “other factors” behind that move (i.e. purchases don’t tend to be nearly as bothered by rising rates, nor do they tend to respond so quickly).

So is there any hope? Can rates return to sub-3% levels any time soon? Are they going to continue to move much higher?

Be prepared for rates to be stubborn about moving quickly lower. The economy has a lot to look forward to. It would take time for some of the more economically bearish scenarios to play out in a way that helps rates significantly. If we see things improve in the near term, it would most likely result from behind-the scenes trading motivations that have nothing to do with economic growth, inflation, or Fed policy. In other words, they’d be largely technical in nature, and thus not something to plan on.

How about stocks? If stocks fall, could that help bonds/rates?

It can help to some extent, but I’d caution anyone against expecting high rates to cause sustained selling in stocks which, in turn, helps rates come back down. That was a common refrain at the end of 2018, but it certainly wasn’t that simple. Moreover, the two time frames are different in several important ways. Will you be able to see stock prices and bond yields move like this? Yes…

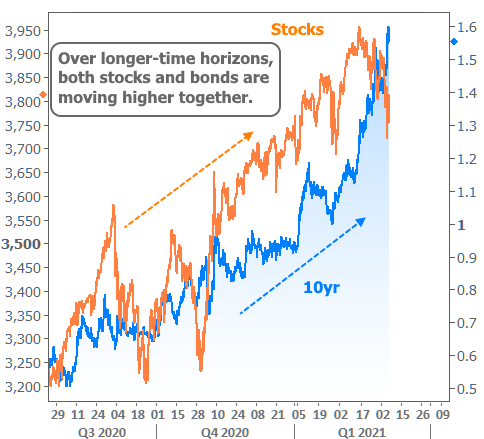

But that movement doesn’t always mean that rising rates are hurting stocks. More importantly, the takeaway can change when we zoom out.

So is there any shred of hope?

Absolutely! There’s always hope. Rates only rise so much, so fast before the market corrects. While it’s impossible to know how the new realities of the pandemic will affect the normal time and scope of such things, it’s no less of a certainty. If you need a rate chart to help put the super big picture in perspective, the past few decades of 10yr yields is always a solid choice.