Rates are on hold until the next chapter is written in the complex saga of covid versus the market. This isn’t to say rates perfectly flat–simply that the prevailing momentum has been sideways for the past few weeks.

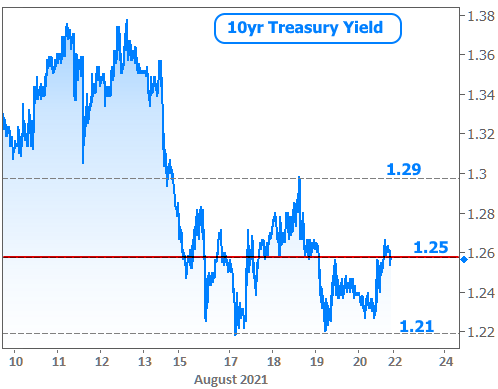

Since mortgage rates only change once or twice a day, we can use 10yr Treasury yields to see finer detail. This entire week took place in the fairly narrow range of 1.29 to 1.21, and it ended with yields precisely in the middle at 1.25%.

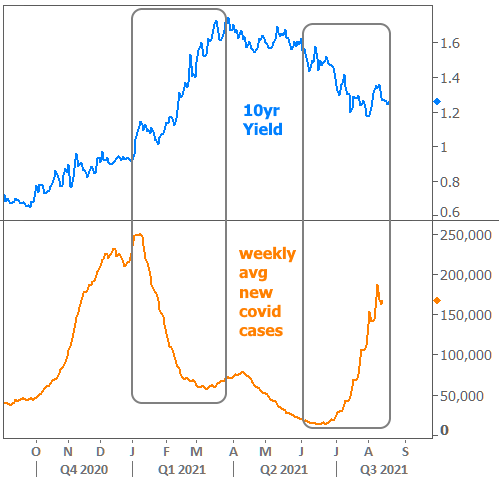

Zoom out a bit and 1.25 remains at the center of a slightly wider (but still very “sideways”) range.

What’s the point? Bonds (and thus “rates”) are muddling through a period of indecision as they wait for clarity. Bonds ultimately care most about things like the economy and Fed policy. In turn, the economy and the Fed have a lot riding on the covid outlook.

The burning question: Will the delta surge do even a fraction of the damage to the economy seen during the initial covid surge?

It certainly doesn’t look like it will be in the same league at the moment, but the point is that we’re nonetheless forced to wait and see. In fact, it’s not unfair to say that bonds are lost in the desert between two familiar towns: one that is pretty unpleasant in terms of interest rates and the other that is equally unpleasant from a public health standpoint.

Where will clarity come from? It’s complicated. The Fed can give us clarity on how they will approach things. We got a taste of that on Wednesday with the release of the Minutes from the most recent Fed meeting. But that meeting happened at the end of July and a lot has changed since then.

Because of that, many market participants are looking for clarity from Fed Chair Powell when he speaks (virtually) at the Fed’s Jackson Hole symposium next Friday. Based on the tone in Wednesday’s Minutes, it would be a surprise to see Powell signal an abrupt shift away from the Fed’s rate-friendly policies just yet.

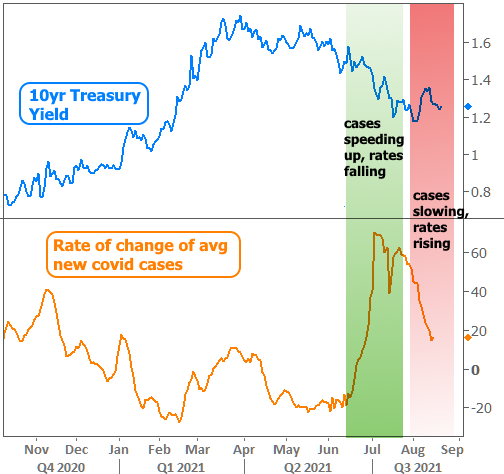

The more important clarity comes from covid numbers. Indeed, all other sources of clarity depend on the covid outlook to some extent. Markets know this. As such, big swings in covid numbers offer one of the simplest explanations for the broad trends in rates.

Traders looking to get ahead of the curve may be honing in on the acceleration and deceleration in daily case counts. While cases are obviously still rising, they’re not rising as fast. If that trend continues (and especially when it reverses), it will be increasingly challenging for bonds and rates to maintain composure. In other words, falling daily case counts would make a strong case for upward pressure on rates.

What does all this mean in plain English? Rates are low–much lower than most anyone expected at this point in the year. The key reason is “delta” and Fed’s patient approach to changing rate-friendly policies. The lingering concerns about the nature of the post-covid economy also make the list.

For what it’s worth, the Fed may have been nearly as patient without the delta variant. They’ve consistently said that there’s much to learn about the state of the post-covid economy after the new school year gets underway.

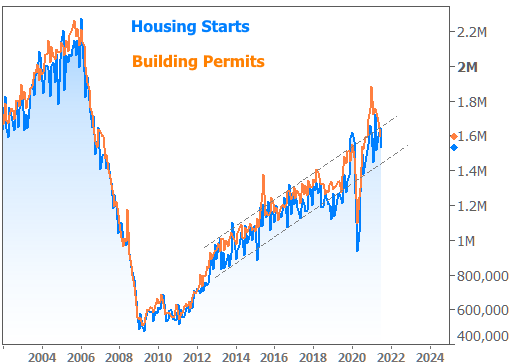

At the moment, economic data is mixed, depending on where you look. In many cases, numbers have returned in line with pre-covid trends. Residential construction (updated this week) is one example of this with a big drop at the outset of the pandemic and a now-resolved correction to long-term highs.

Unsurprisingly, homebuilder confidence (also released this week) has taken a similar path.

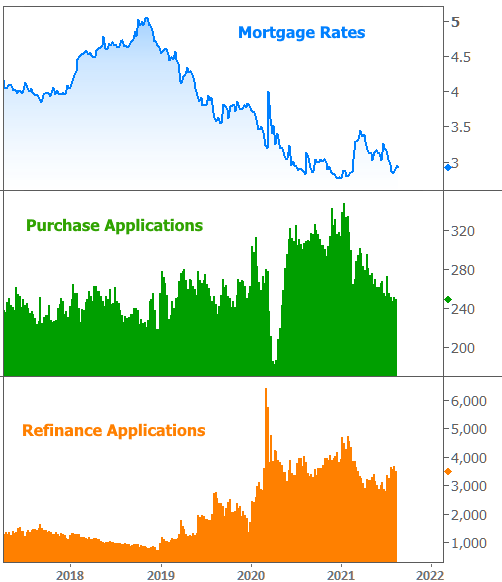

Mortgage applications (released every week) show a similar trend on the purchase side, but refinances remain logically elevated due to the persistence of low rates.

Next week brings a more robust economic data calendar, but expect it to be overshadowed by Friday’s Powell speech (currently scheduled for 10am ET).