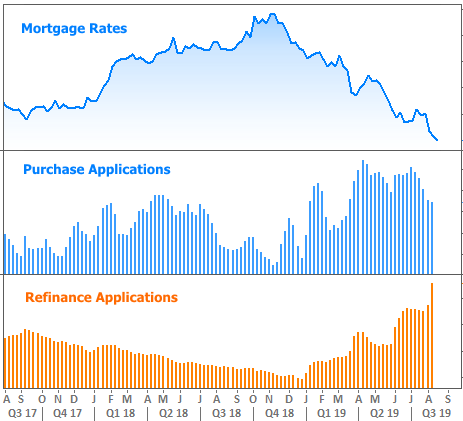

This week, the Mortgage Bankers Association (MBA) released application numbers that confirm what almost anyone in the mortgage industry could have already told you (if they could find the time and energy!) A new refi boom is underway.

The refi numbers are all the more impressive considering how hard-fought the mortgage rate improvement has been. There’s a lot of confusion out there about why we’re not seeing even more improvement relative to Treasuries. That relationship will eventually heal itself as long as we can avoid a massive rebound in Treasury yields. We’ll take a look at the factors informing that risk, but first let’s get caught up on how markets moved this week, and why.

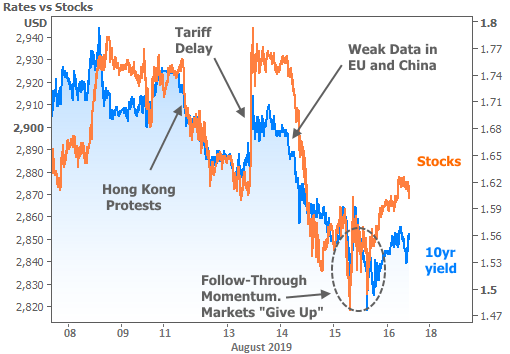

Rates (Treasury yields) and stocks surged lower again as investors remained unwilling or unable to fight back against an onslaught of global growth concerns. Specifically, stocks couldn’t manage to break above last week’s ceiling despite some good news about tariff delays. Rates didn’t even really try to bounce. Both sides of the market quickly gave up whatever fight they had left after a slew of weaker economic data in Europe and China.

These are incredibly low levels for the 10yr Treasury yield–within striking distance of the all-time lows at 1.32%. Considering we were over 2.00% just 3 weeks ago, this has also been an incredibly fast move–so fast that it makes sense to wonder how much longer this can go on and whether we should worry about the rebound effect that historically follows such moves.

We can get an idea of how much we should worry based on several factors:

- How does the current move stack up to past examples?

- Why is this all happening and how likely is that to change?

- How does all this translate to mortgage rates given the recent discrepancies between mortgages and Treasury yields?

Comparing the current drop in rates to past examples

When it comes to the drop in rates that began in late 2018, one modern example stands out from the rest in terms of similar past precedent. In 2011, rates were moving up from long-term lows. The economy looked like it had turned an important corner (it had, actually). Rates subsequently rushed higher. But a burgeoning crisis abroad and doubts about the sustainability of our domestic expansion led to a massive stock rout and sparked a drop in rates that hasn’t been equaled since.

The chart below highlights the 2011 move and also shows how it would unfold if it were to begin at the same time as the present rate rally. In other words, 2011’s example suggests it could be very early to worry about about the longevity or pace of the present move. If things play out in a similar way, we’d keep moving lower through early 2020 and ultimately see 10yr yields BELOW 1.00%.

Of course all this is very speculative. We could also bounce here and never see rates this low again, but that stance seems to be harder and harder to support with facts and logic. This brings us to the next factor.

Why this is happening and what might change that.

There is no single reason for this epic drop in rates. It has taken a village. That village includes (but is not limited to) the following:

- Slower growth in Europe and China (already a factor before the trade war flared up)

- The trade war (probably the biggest deal as it brings economic impact AND uncertainty)

- Overly cautious Fed rate stance at the end of 2018 paving the way for an increasingly aggressive stance in 2019

- Market concern that the Fed isn’t being aggressive enough

- Ultra low foreign bond yields helping drive extra demand into US bonds

What might change these “villagers?” Frankly, it’s hard to make a case for the slowdown in global growth suddenly curing itself while trade-related uncertainty persists. That uncertainty will continue to force the Fed’s hand as long as inflation doesn’t pick up (it hasn’t given any such indication yet). There alone, we have plenty of reason NOT to panic about a massive reversal. These things will take time to change course, even if they begin to change course immediately.

Mortgage Rates vs Treasury Yields–The 3rd Factor

The first two factors should actually set some minds at ease–not because they predict the future, but simply because they suggest no need to panic about a reversal for reversal’s sake. The 3rd factor has been and will continue to be a thorn in our side, however. We talked all about it last week, and you can revisit that newsletter via this link if you like.

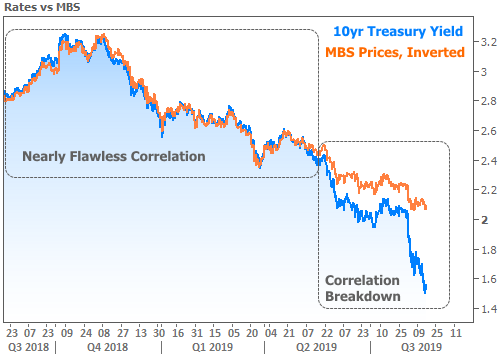

To make a long story short, mortgage rates aren’t the only rates out there. They exist in an ecosystem with more established players like US Treasury yields. They move so much like Treasury yields that even very smart people mistakenly believe Treasuries (specifically, the 10yr) dictate mortgage rates. Recently though, mortgage rates have moved in the opposite direction from Treasuries at times, or simply haven’t fallen remotely as much as Treasuries suggest.

The reasons for the discrepancies have to do with the fundamental differences between mortgages and Treasuries as investments, as well as the increased costs for mortgage lenders created by volatility. Again, you can read all about it in last week’s newsletter, but the important point is that it will take TIME for mortgages to close the gap. We can see just how pronounced the divergence has been by looking at the movement in MBS (the mortgage-backed-securities that actually dictate the rates that can be offered by lenders) compared to the 10yr Treasury yield.

I’m not including this “MBS vs Treasury” factor to add to concern about a potential rate spike. This is more of a reminder about the headwinds that are specific to the mortgage industry even as the rest of the world talks about “the lowest rates in years.” Mortgage rates are the lowest in years as well, they’re just not going to be making additional progress as quickly as Treasuries can.

Looking Ahead

In this environment, it’s hard to place too much or too little emphasis on scheduled events in the future because so much of the market’s inspiration has come from unscheduled surprises. Still, there are two potentially important calendar items next week. The Federal Reserve releases the minutes from its most recent meeting on Wednesday. These can occasionally contain market moving surprises, but investors are slightly more interested in hearing what Fed Chair Powell has to say at the Jackson Hole Symposium at the end of the week. Granted, both of these events could turn out to be duds (we have a pretty good feel for where the Fed stands on economic risks and monetary policy), but they also have potential to cause some volatility.