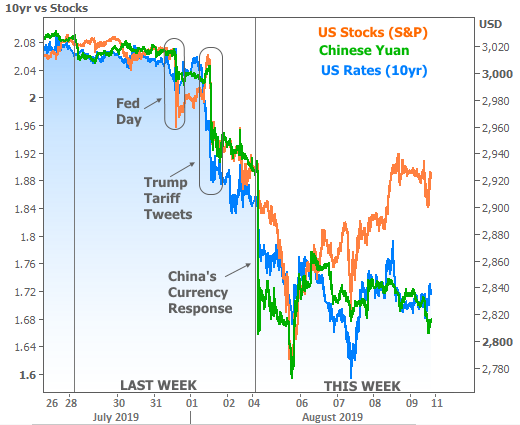

Market volatility has been fairly intense over the past week and a half with trade war drama taking the spotlight away from the Fed and economic data. The following chart shows the Fed announcement last Wednesday being trumped by Trump’s tariff tweets on Thursday and then again by China’s decision to weaken its currency (Yuan) over the weekend (viewed as a big escalation in the trade war).

By the end of the week, stocks had managed to recoup more than half their losses, but interest rates were able to remain relatively lower thanks to strength in the European bond market (not mentioned in the chart) and ongoing Yuan weakness.

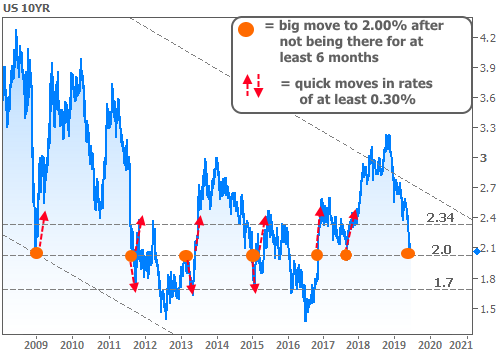

Before we continue, recall a few newsletters back when I pointed out the tendency for rates to experience a volatile swing of about 0.30% in 10yr yields any time there was a sharp move to the 2.00% level. This was the chart that accompanied that warning about increased volatility risks:

Clearly, that prophecy has been fulfilled, and in a friendly direction for rates (10yr yields actually made it briefly below 1.60% this week!). But not all rates are benefiting equally! As you might have guessed based on the title and the fact that you’re reading a housing/mortgage market newsletter, we’re talking about mortgage rates!

Even the savviest market watchers often mistakenly believe mortgage rates are dictated by the 10yr Treasury yield. While it’s true that 10yr Treasuries tend to move for the same reasons as MBS (the Mortgage-Backed-Securities that truly govern mortgage rate movement), MBS and thus mortgage rates have their own set of concerns. Sometimes, these concerns create situations where mortgage rates seem to be stuck in the mud relative to Treasury yields.

What follows is a relatively definitive primer on exactly why this happens and what will need to happen for normalcy to be restored.

What exactly are we talking about?

MBS prices and lenders’ mortgage rates have a tendency to improve much more slowly compared to the broader bond market during times of fast movement toward lower rates. Volatility compounds the issue.

Why are we likely to see this time and again in the future?

This is not some unique, one-off occurrence. Mortgage rates will always fall more slowly than, say, 10yr Treasury yields when longer-term interest rates are experiencing a rapid move lower because of their fundamental differences.

What fundamental differences are those?

If you buy a 10yr Treasury Note, you KNOW that it will pay you x% of interest for exactly 10 years. Nothing changes that. If you buy a mortgage, you know it will pay you x% of interest for 30 years IF AND ONLY IF the borrower doesn’t sell, refinance, die, get foreclosed on, etc. Of these options, refinancing is by far the most volatile consideration, so we’ll focus on that aspect from here on out (i.e. foreclosure rates are very small and “time in home before selling” is very stable on average. These things are very easy for investors to account for when deciding how much to pay for a loan).

Why is refinance probability more volatile and harder for investors to account for?

Easy one! Because investors can’t predict the future of interest rates, and interest rate movement has a direct effect on someone’s likelihood to refinance!

So why does that refi probability matter?

This is the crux of the issue. When you buy a mortgage, or a pool of mortgages in the form of a MBS, you will typically pay more than the face value of the mortgage (aka “premium”). In exchange, you will collect enough interest over time to more than make up for that premium (hopefully!).

Think about the last 2 sentences for a second. You just paid $102,000 for someone’s $100k loan thinking you’ll be pocketing the interest for a few years. Let’s say that’s $3k in interest in the first year. Great right?! You will make $1k if they just stick around for 1 year!

But in a market with rapidly falling rates, they might refi in only a few months. That means you might earn much less than $2k in interest. If that happens, you’d LOSE money by buying this mortgage!

The nitty gritty specific numbers in this scenario aren’t important, but the concept is at the heart of how investors place value on mortgages and MBS.

Is there some needlessly esoteric term that refers to this phenomenon, you know… so I can impress my friends when I talk about the mortgage market and rate movement?

You bet there is: NEGATIVE CONVEXITY!

Unless you have a strong background in finance or bond trading, don’t worry about trying to understand this term. It refers to a curve that plots the relationship between rate movement and the price of buying a bond.

In a regular bond, like a 10yr Treasury, the relationship between an investor’s rate of return and the price paid for the bond is pretty linear. But that’s definitely NOT the case for a mortgage. This all has to do with the borrower’s ability to refinance if rates get lower or to avoid selling/refinancing if rates spike.

Can you say that in plain English?

If interest rates drop quickly, more mortgage borrowers will want to refinance. If an investor paid a premium for their loans (like paying $102k for a $100k loan), the investor is more likely to lose money. So investors preemptively offer lower prices when rates are falling rapidly. Instead of paying $102k, they might only pay $101k–as they assume the borrower won’t stick around in that loan long enough to generate much more than $1k of interest.

Granted, this is an oversimplified example with nice round numbers, but the concept is the important part.

Right, and what was that concept, specifically?

Lower rates = more refi demand = more risk that investors won’t collect enough interest to offset the premium they paid for the mortgage = investors pay less for mortgages = downward pressure on MBS prices.

And why do I care how much an investor pays for a mortgage? Their problem, not mine, right?

Wrong… The more an investor is willing to pay for your loan, the less you have to pay. You might realize those savings in terms of lower upfront costs or a lower interest rate.

That’s confusing… How can my rate be lower if the investor is paying for a certain rate of return? If the investor is buying a 4% loan, isn’t my rate going to be 4%?

Not always. The investor’s rate of return is a function of your payment rate and the PRICE they pay for your loan. So paying a lower price is the same as bumping the payment rate as far as they’re concerned. In other words, if your loan is 3.875%, the investor has a calculation that allows them to pay a bit less in order to realize the same amount of profit over time. That’s why it costs you extra money upfront (i.e. paying points) to “buy down” your mortgage rate.

So if investors think I’ll refi sooner than normal, they might want more money upfront, which I can either pay upfront or in the form of a slightly higher interest rate?

I’m not so sure you need this primer after all! Yes! Lower MBS/Mortgage prices = higher rates

OK, but rates are still lower than they were a while ago, it’s just that 10yr Treasury yields are a LOT lower. Why?

Great question. To investors, the value of investing in mortgages is always thought of in RELATIVE terms to a risk-free benchmark like Treasuries. In other words, they are asking themselves how much extra yield they need to see in order to be compensated for the risk that you’ll refi early. The faster rates are falling, the more they’ll want. But if Treasury yields are falling fast enough, mortgage rates can still move lower even as the gap between the two continues to expand. It’s all about the spread between mortgage rates and Treasury yields. When refi risks increase, that gap tends to widen.

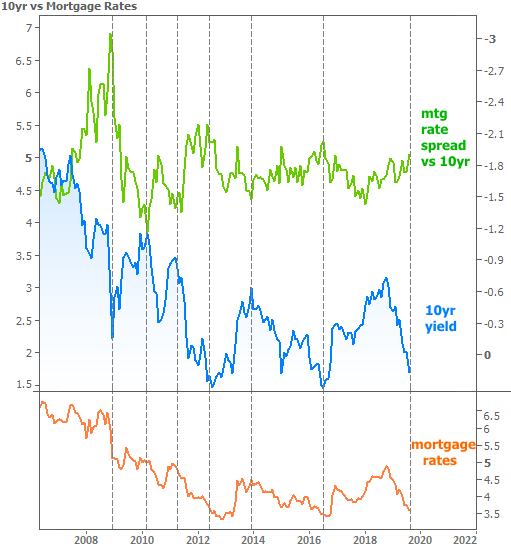

The following chart shows this happening like clockwork. In each case, the vertical lines show long-term highs or lows in rates corresponding with long-term highs or lows in the gap between mortgages and Treasuries. In other words, when rates drop quickly to longer-term lows, mortgages can’t keep up (which is a bummer for consumers hoping for lower rates). When rates spike quickly to long-term highs, mortgages still can’t keep up (which is nice for consumers in that case, because it means rates aren’t rising as quickly as Treasuries).

If this is confusing at first glance, spend some extra time looking at the chart and reading the previous paragraph. 30yr fixed mortgage rates are always higher than 10yr Treasury yields. The higher the green line, the wider that gap is.

I’m good with the explanation above, can you make it a bit more technical for me?

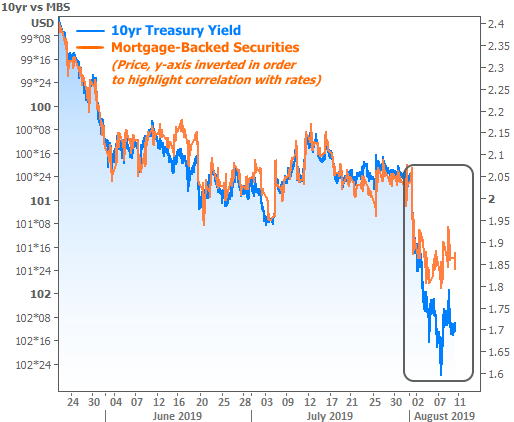

Really? No one ever asks for that, but here you go: a chart of 10yr Treasury yield movement versus the chart of MBS prices (what investors are paying for groups of the most common mortgages). The MBS prices have been inverted in this chart in order to show the correlation with 10yr yields (because prices and yields vary inversely for bonds and mortgages).

What’s the bottom line on the effects of all this?

First off, we should always expect rates to have a hard time keeping up with a massive, unexpected move lower in Treasury yields. If the bond market can hold anywhere near current levels and especially if it can stabilize with less volatility around these levels, mortgage investors will get more and more comfortable making assumptions about borrowers’ predisposition to refinance. That will allow mortgage rates to GRADUALLY move closer to Treasuries.

One other bottom line not addressed above, but that functions in a similar way has to do with VOLATILITY. Big swings in bond prices make it more expensive for mortgage lenders to conduct business. Volatility increases the costs lenders pay to ensure they can honor the rates being locked by consumers (and the costs to offset the money lost when consumers break a lock agreement due to market volatility). As such, as volatility decreases, lenders can tighten up margins between the rates they’re offering and the rates implied by what investors are paying for mortgages.

The BOTTOM bottom line, then: there has been a double whammy for mortgage rates’ ability to keep pace with Treasuries:

- Investors are offering relatively lower prices for mortgages/MBS due to a rapid drop in rates and the uncertainty about where we’ll go from here.

- Lenders are increasing margins to offset the increased costs associated with volatility.

Where can we go from here?

It would be good for rates to hold steady right now, and to avoid any big swings from day to day. In that scenario, 10yr yields could stay perfectly flat, and the average 30yr fixed rate could fall another 0.125% to 0.25%. This isn’t a prediction–simply a comment on how much recent volatility is costing the mortgage world.

Rates, in general, can always move higher or lower. They’re likely to continue taking guidance from a mix of economic data and relevant headline events (like trade war updates and tariff tweets). Next week brings moderately important econ data with the Consumer Price Index, Philly Fed Index, and Retail Sales Report being the biggest potential market movers.