For anyone following interest rates very closely in 2013, the taper tantrum is not easily forgotten. It describes the bond market’s knee-jerk response to the realization that the Federal Reserve would be winding down its bond purchase program. With the Fed almost certain to make a similar announcement next Wednesday, should we be scared yet again?

In a word: no.

Of course, we’ll need to qualify that. First off, whether or not we should be scared has little to do with whether or not the taper announcement will push rates higher. Perhaps the better question–the one to which we can answer a more unqualified “no”–is as follows:

Should we be afraid that next week’s tapering announcement from the Fed will push rates higher?! There are a few reasons we can answer “no” to that question.

1. Past Precedent

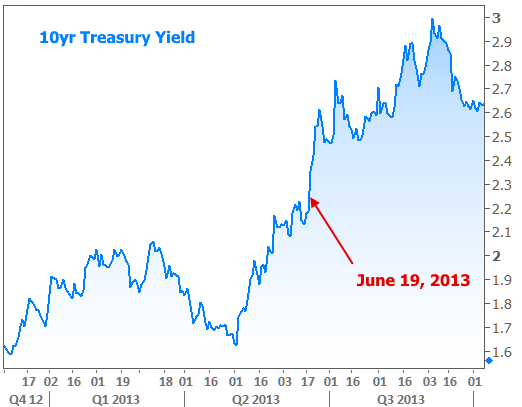

You know the old disclaimer about past precedent not being a guarantee of future performance? That’s true here too, largely because the pandemic creates a different backdrop for the market compared to 2013. Still, of the 3 times the Fed has announced a reduction in its bond purchases, rates have done the same thing every time. (QE = quantitative easing… market-speak for outright bond purchases from the Fed).

Yes, the chart above is counterintuitive. After all, if rates are based on bonds, and Fed bond buying demand pushes rates lower, wouldn’t we logically expect that rates would rise when the Fed buys fewer bonds? That would be true if everything the Fed did was a surprise, but…

2. Next Week’s Fed Tapering Announcement Will Not Be a Surprise

You want to see markets surprised by a Fed tapering announcement? Check out June 19, 2013. That’s the day often considered to be the grand opening of 2013’s taper tantrum.

Indeed, markets were surprised by that. You may also be surprised to learn that the Fed didn’t actually announce tapering until December 2013! In June, they merely said tapering was likely by the end of the year.

Here’s another surprise:

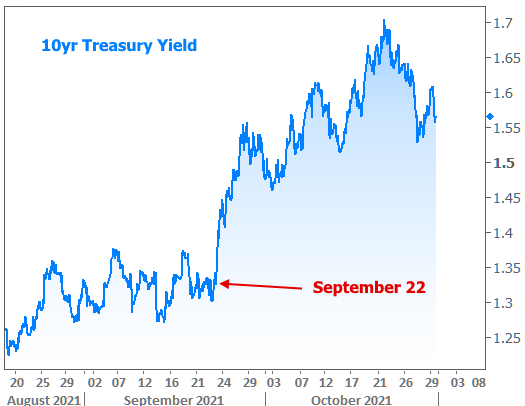

3. 2021’s Version of June 2013 Already Happened

Remember September 22nd? Rates had been flat, low, and relatively drama free for months when Fed Chair Powell all but promised to taper on November 3rd during the Sep 22 press conference. Granted, that wasn’t the only ball in play for the bond market, but it was the biggest.

The Bottom Line.

The bottom line is that the Fed and everyone else was cognizant of the damage done by mismanaged expectations in 2013 (they tried, but inconsistencies in economic data made for a perfect storm). They’ve been determined to give the market ample notice. Even without the notice, we knew tapering was coming eventually. In fact, markets were already starting to prepare for it by the end of 2020, thus making for a sort of slow-motion taper tantrum.

Again, this doesn’t mean rates can’t keep going higher. But if they do go higher, it won’t be because the market was surprised by next week’s tapering announcement. Similarly, if rates go lower, they’ll have to find their own justification.

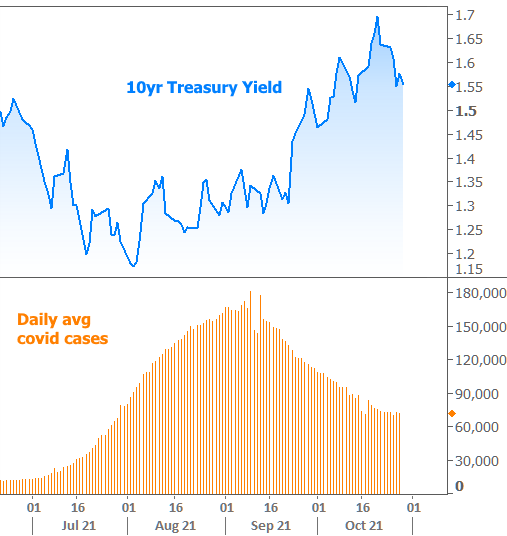

One thing to keep an eye on as temperatures grow colder is a potential shift in covid case counts. They’ve been trending reliably lower since September, but now look to be leveling off.

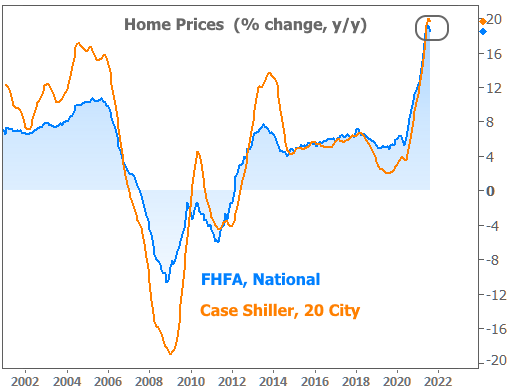

As far as home prices are concerned, rising rates might not be a bad thing. With August’s price data in this week, we already have the first signs of a deceleration in the record-setting pace of appreciation. It’s small for now, but experts expect price growth to fall significantly from here (note: that’s price GROWTH… not prices themselves).

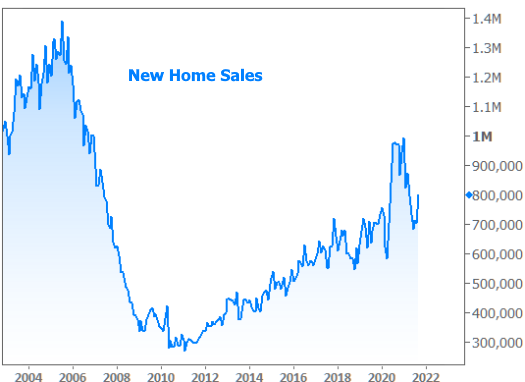

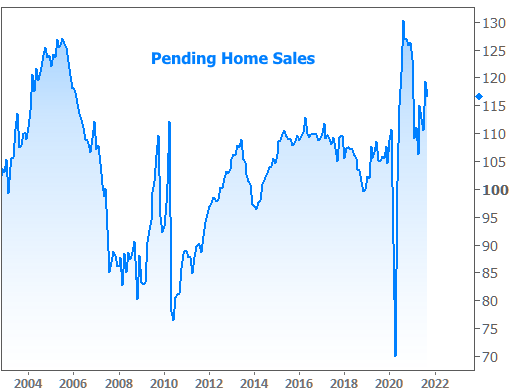

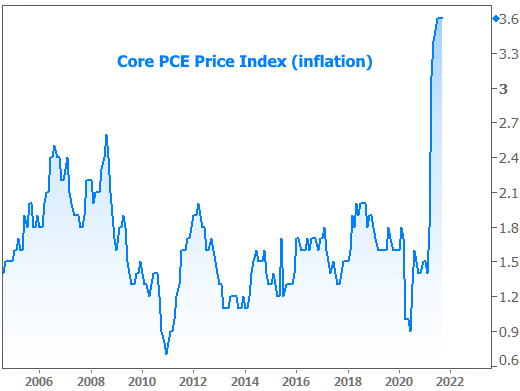

In other housing and economic news this week, New Home Sales surged, Pending Home Sales remained respectable, and inflation was right in line with economists (very high) expectations.

In addition to next week’s Fed announcement (Wednesday afternoon), there’s a smattering of other important economic data culminating in Friday’s big jobs report. Ultimately, markets may choose their game plan based on how other traders are trading before and after the Fed (i.e. data might suggest one thing and rates might do the other).