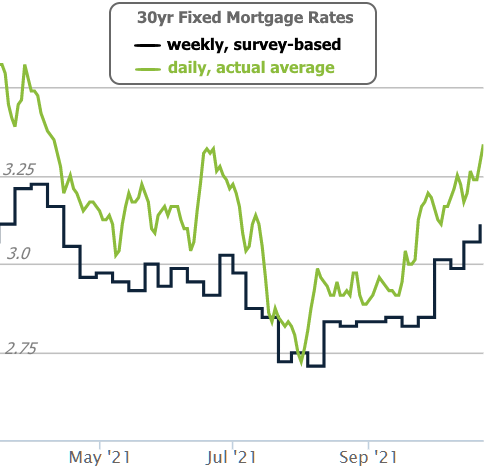

Over the past 30 days, interest rates have risen sharply. This is true for both mortgage rates and bond market benchmarks like 10yr Treasury yields. But another version of the 10yr Treasury yield continues to operate near all-time lows.

How can rates simultaneously be rising quickly but still near all-time lows? Inflation!

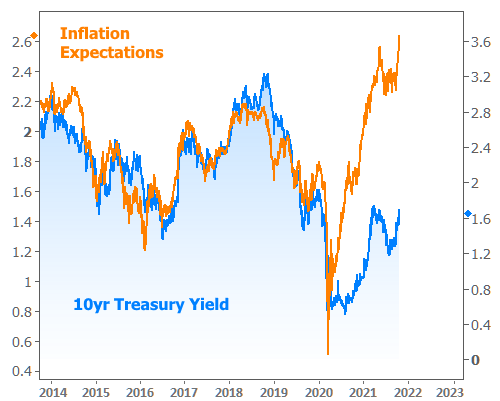

As we discussed last week, inflation erodes the value of bonds. As such, bond yields frequently move in response to changes in inflation expectations (higher inflation = higher rates). That correlation is easily seen in the following chart:

Obviously, something changed in 2020. But what changed specifically for bonds and inflation? For starters, the Federal Reserve immediately began buying massive amounts of bonds shortly after the pandemic began. This acted to keep yields lower than they otherwise might have been. Beyond that, there had been (and possibly still is) some reason to believe that post-pandemic inflationary pressures are temporary and thus not alarming enough to warrant a surge toward higher rates.

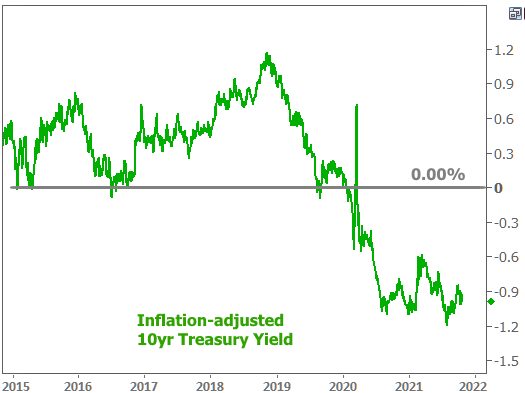

Between now and the time that inflation subsides (if it subsides), the mismatch between 10yr yields and inflation expectations means the actual rate of return (factoring out the effects of inflation) is still near all-time lows.

In other words, the “real” rate of return for 10yr Treasuries is low. Unfortunately, this doesn’t do you much good out in the real world. It’s just an economic concept that helps us reconcile the reasons for rising rates.

And rates have certainly been rising. While it’s hard to see given the scaling of the chart, even the inflation-adjusted rate of return has been moving up recently. A big reason for this is the growing level of concern over the inflation trajectory.

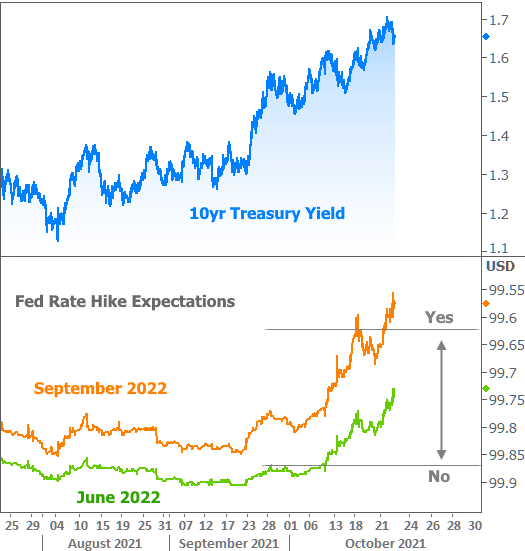

Several months ago, policymakers were more confident that supply bottlenecks would only result in temporary inflation spikes before prices began to settle. But we’re not seeing things settle down as quickly as they expected. As a result, market participants quickly ramped up expectations for the first Fed rate hike.

These expectations are conveyed via the trading of Fed Funds Futures contracts. Each contract pertains to a calendar month. The following chart shows the July and October of 2022. These would correspond to the scheduled Fed meetings that take place in June and September 2022 respectively. The higher the line, the more the market is betting on seeing the 1st rate hike by that calendar month.

Translation: at the beginning of the month, traders only saw a small chance of the first rate hike happening in September and no chance for June. Fast forward 3 weeks and September is seen as 100% likely and June is up to about a 60% chance.

Before the Fed hikes rates, it must be all the way done buying Treasuries and mortgage-backed securities (MBS). This isn’t a guess or an opinion. It’s something that multiple Fed speakers have asserted time and time again. As such, the market quickly came to the understanding that the Fed would have to taper soon and possibly in larger chunks compared to 2013. This is one of the reasons that rates have risen as quickly as they have in the past few weeks.

Tapering has a massively negative connotation to anyone who tuned in to 2013’s drama, but it’s important to remember that we’ve already seen quite a bit of the bond market tantrum this time around. It was much more orderly because we knew it was coming and even roughly WHEN it would come. This doesn’t mean rates won’t continue higher from here. Indeed, that’s the baseline assumption for many traders through the end of 2021. But past precedent suggests rates are certainly capable of falling the very moment the Fed removes accommodation. Remember this chart from last week which shows the 3 major past instances of Fed bond buying:

This Week’s Housing-Related Data:

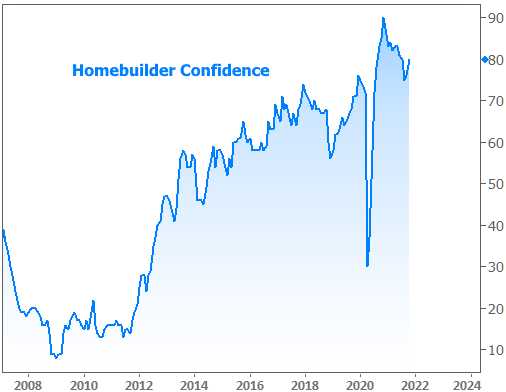

Several housing-related economic reports received fresh updates this week. Homebuilder confidence was out on Monday with the first noticeable improvement in months.

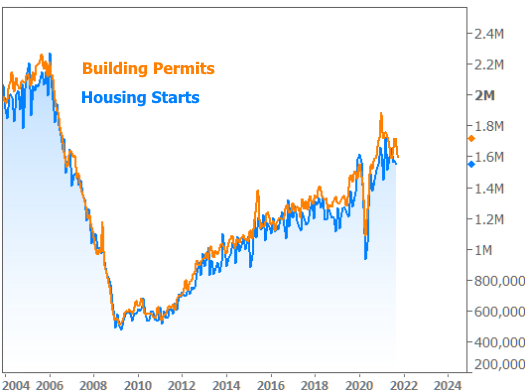

Residential construction data followed the next day. Building permits and housing starts (the groundbreaking phase of new construction) both declined, but remain at higher levels than before the pandemic.

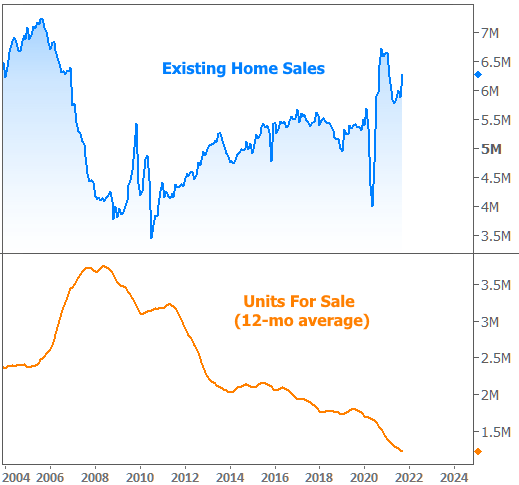

Thursday’s Existing Home Sales report was stronger than expected despite record low inventories.

Keep in mind, however, this is for the month of September and as we just discussed, rates have risen sharply since then. Not only that, but there’s typically additional lag between big rate changes and any impact on home sales numbers. That means mortgage rates are as much as half a percent higher than they were when the sales data was being collected.

Of course rates aren’t necessarily a leading indicator for purchase activity, but they definitely have an effect–especially on prices. Next week brings an important update on home prices with both Case Shiller and FHFA releasing monthly numbers for August. This is the 2nd to last month of data that will go into the calculation to determine next year’s conforming loan limit. Prices have already risen enough for new limits to be roughly $627,000. Any additional gains in August and September will only make the new limit bigger.