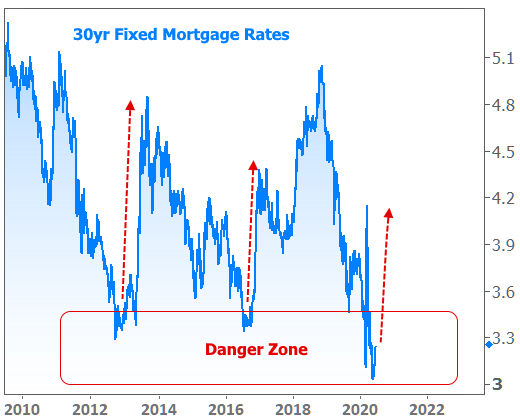

Things are quickly getting interesting for mortgage rates, and by ‘interesting,’ I mean potentially alarming. Everything’s relative though, so it should be said right up front that the average mortgage rate is still only a hop and a skip from the all-time lows seen last week.

But the recent past and present are old news when it comes to discussing rates and financial markets, right?! We want to know what the future holds! We want to know if rates are going to spike like they did the last 2 times they entered the danger zone.

Up until this week, there was a fairly even balance of opinion among analysts, economists, and mortgage market stakeholders. It was and still is perfectly valid to believe rates have an equal chance of pecking away at new all-time lows versus embarking on a journey back toward much higher levels.

That said, those who saw equal chances of higher vs lower rates are being forced to question their resolve after the past 3 days of economic data and market movement. Reason being: the data suggests an economic recovery is off to a much faster start than expected.

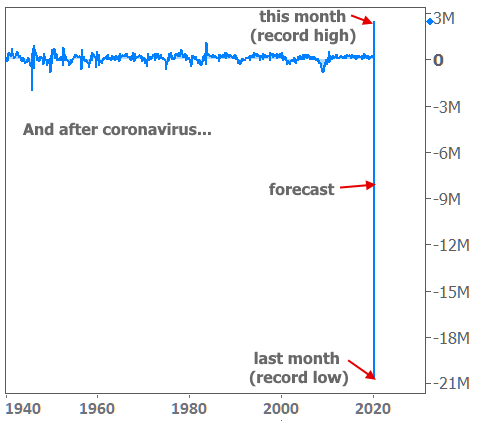

This began on Wednesday with a jobs count from payroll processor ADP that was staggeringly higher than expected. Ironically, this was the 2nd worst ADP Employment report in history. Only last month’s was any weaker, and it was only due to that weakness that economic forecasters were able to miss the mark so egregiously this month. Specifically, they saw ADP’s job count declining by another 9 million on top of last month’s 20 million decline. As it happened, only 2.76 million payrolls were lost.

Opinions vary as to how well the ADP numbers predict the all-important payroll count in the government’s big jobs report (almost always released 2 days after ADP). But when ADP is THAT far from forecasts, investors can’t help but expect some drama in the official jobs report.

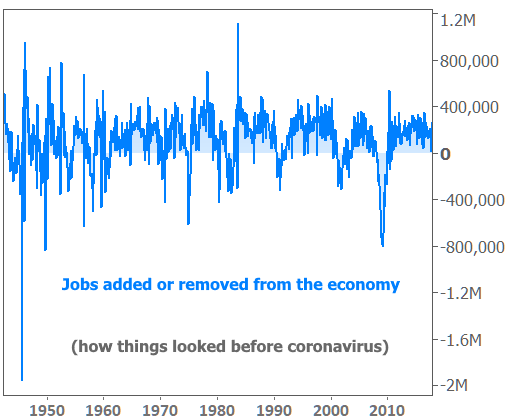

That instinct was vetted on Friday when the jobs report absolutely demolished its forecast with payrolls RISING 2.5 million versus a forecast calling for a drop of 8 million. This is by far and away the biggest gap we’ve ever seen and one that’s unlikely to be repeated. That said, coronavirus has forced the market to redefine what’s possible in terms of temporary economic outcomes. Here’s the entire history of the Labor Department’s jobs count before coronavirus effects.

Now let’s bring the post-coronavirus numbers into the mix so we can see how the past stacks up (and how far off the forecasts were):

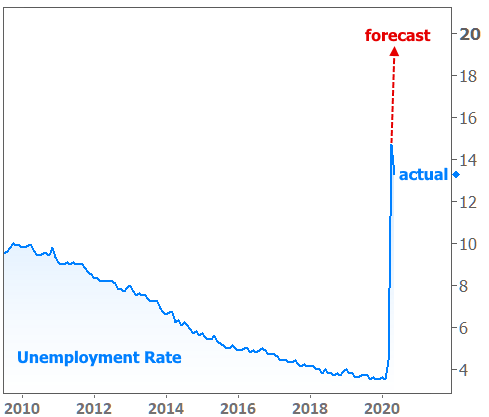

Even though these numbers are arguably too big and too different from the past to observe much significance, they corroborate stories being told elsewhere in the economy. The unemployment rate (also released on Friday) is an even more basic way to convey the message that the labor market may already be healing significantly, even though experts thought it would continue to deteriorate.

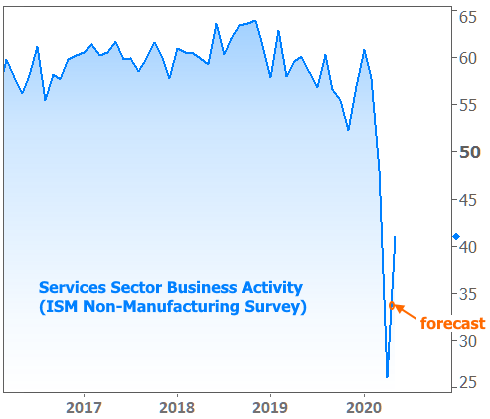

There are ways to observe the same message in other highly-regarded economic reports. A key barometer for the services sector was released on Wednesday. While economists accurately predicted an improvement, they vastly underestimated the pace.

Yes, that blue line is still much lower than it had been in recent years, but we already knew about that. What we didn’t know was the pace at which it might bounce back. Combined with the stronger jobs numbers, data like this suggests the economy is getting back to business more quickly than expected.

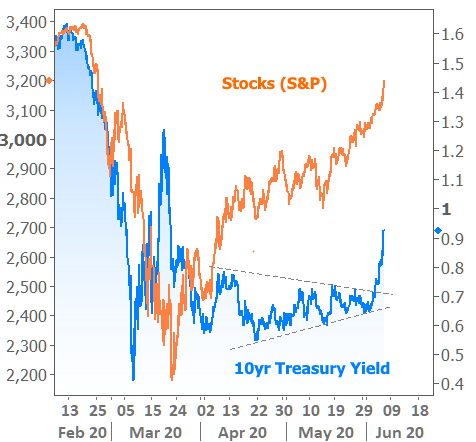

So what’s the big deal for mortgage rates? Rates are based on mortgage-backed bonds. These bonds typically move in similar fashion to US Treasuries. When the economic outlook improves, stocks tend to improve while bonds suffer. “Suffering” in the bond market means lower bond prices and higher yields. “Yield” is just another word for “rates.”

Long story short, stronger-than-expected economic data means upward pressure on rates, all other things being equal. This is easily seen in the following chart, where the 10yr Treasury yield (a key benchmark for interest rates) has broken out of a holding pattern to move rapidly higher this week.

If the economic data continues to be much stronger than expected, there’s a very real chance that all-time low rates are behind us for now. The counterpoint is that such comments are only ever as good as the data we currently have available. The data just so happens to be very strong this week. If the data happens to calm down, so too could the rise in rates.

Either way, mortgage rates have a bit of an advantage over Treasuries because they didn’t fall as quickly in response to coronavirus for a variety of reasons. This means they have a bit of a cushion on the way back up. Additionally, it’s worth keeping in mind that the two abrupt spikes seen in 2013 and 2016 (first chart, above) came in response to specific, massively important events. We haven’t seen the same sort of event so far in 2020. Unless that changes, any rising rate trend will be much more gradual than those past examples.