It’s a busy time of year on a busier-than-normal year, so I’ll keep this short. Those interested in more detail can click through the links.

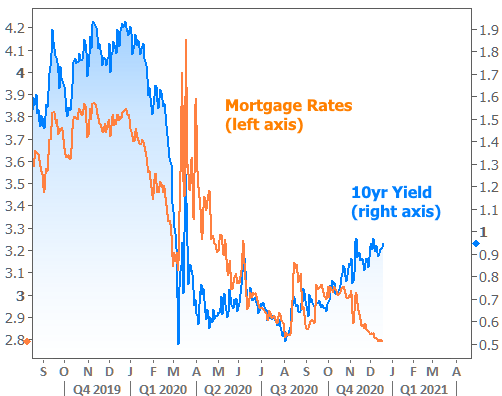

One major theme in the 2nd half of 2020 is that mortgage rates have been insulated from market drama–walking a different path than their usual best friend, 10yr Treasury yields. If you ask Treasuries, the big bounce in rates is already well underway.

Here’s how mortgage rates have bucked that trend:

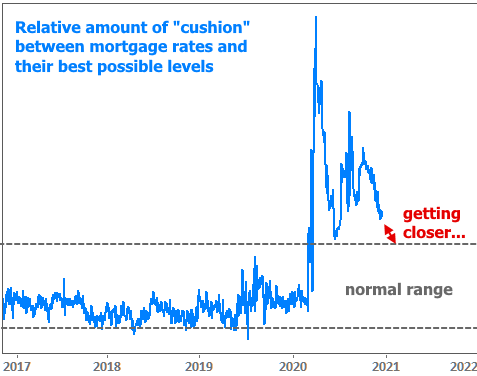

Last week’s newsletter goes into more detail on WHY the insulation exists (revisit it by clicking here), but the important thing to know is that we’re getting closer to “normal” day by day. Once we get there, mortgage rates will be less willing to defy their Treasury counterparts.

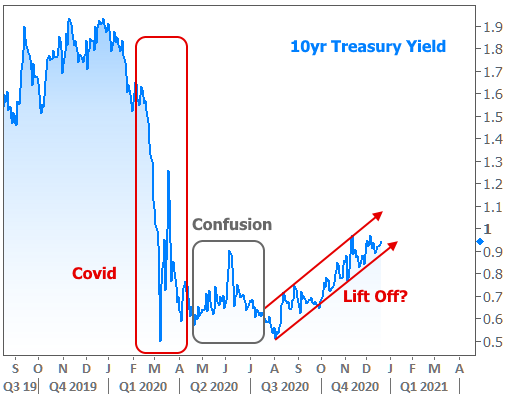

As to the likely fate of Treasury yields, there’s room for movement in either direction. In the bigger picture, rates will take cues from the economic recovery–a multifaceted issue in itself–and the success of vaccine production/distribution.

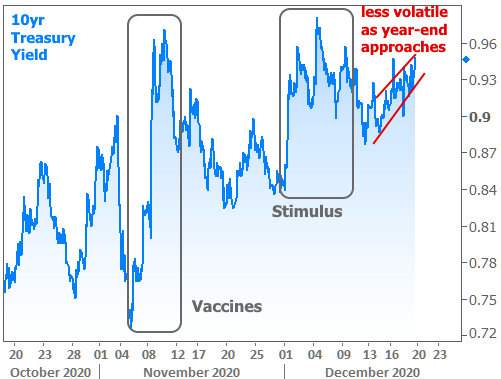

Vaccine news already had a big impact in November. Vaccine headlines have since ceded the spotlight to fiscal stimulus headlines. While there will be one more spat of volatility after congress decides on stimulus (allegedly, before Christmas), the bond market is largely cooling down at this point and getting ready for the next big move. Even the mighty Federal Reserve–frequently the most important consideration for interest rates–failed to stir markets this week (any small scale reaction is completely lost inside the red lines below).

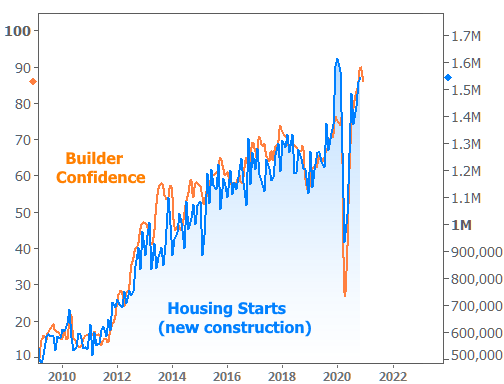

Another theme over the past 6 months has been stunningly strong housing numbers. This week’s construction and builder confidence reports are just the 2 latest additions to the list.