It should no longer come as a surprise that the pandemic continues to create never-before-seen circumstances in all corners of society. Here in the housing and mortgage markets, one of the first major manifestations of the crisis was a quick move to incredibly low rates.

With record after record being set in close succession, the mortgage environment has been ridiculously good for most homeowners. For others, it’s just been ridiculous.

Record low rates make a lot of sense given the economic outlook. In general, economic weakness coincides with lower rates, and there’s been plenty of that to go around.

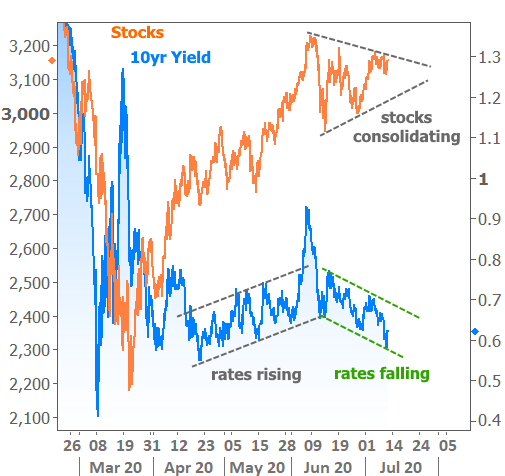

On the other hand, much of the economic weakness is assumed to be temporary. How much is anyone’s guess, but until we see where those chips fall, both sides of the market (stocks and bonds) are finding more buyers than sellers. That’s why stocks are still generally elevated and bond yields (which move lower as demand improves) are remaining low.

Zooming in on the chart above, we can see recent developments more clearly. Stocks are pausing to consider their next move while bond yields (aka ‘rates’) are attempting to trend lower.

The rise and fall seen in bond yields since April reflects the rise and fall in economic hopes as they relate to covid numbers. When everyone was staying at home and numbers were dropping, stocks were excited and bond yields were rising. As quarantines were lifted and more people became sick (or hospitalized, or dead, or however you want to count it), both sides of the market reconsidered their stance.

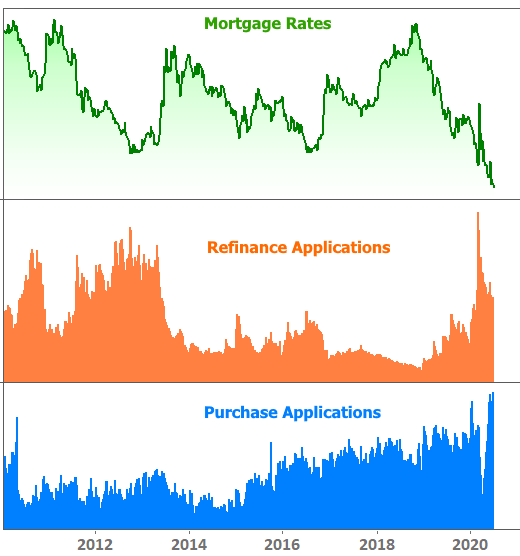

Mortgage rates, however, are setting record after record, and that’s translating to a sharp rise in mortgage activity.

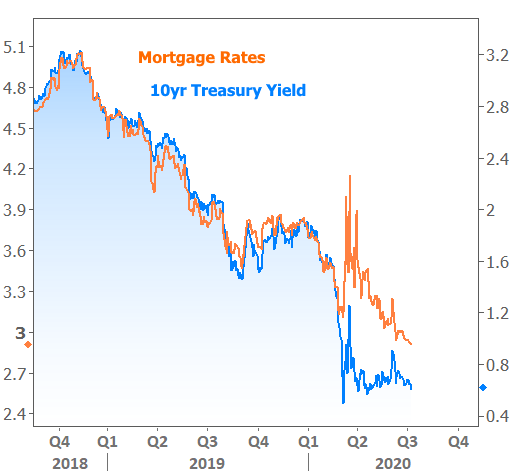

For those accustomed to the very logical and normal practice of using 10yr Treasury yield movement as a rough proxy for mortgage rate movement, this is RIDICULOUS! What gives?

In a nutshell, mortgage rates are still falling because they weren’t able to keep up with Treasuries when rates initially plummeted earlier this year. They’ve slowly and steadily been making up for lost time.

In addition to being a perfect explanation for recent mortgage rate momentum, this chart also serves as a bit of a warning. Mortgage rates are quickly exhausting their advantage and will soon be in a position where they’re forced to move higher if the rest of the bond market is moving higher.

So as it turns out, rates really aren’t that ridiculous once we dig into it. But there are other places to look in the current mortgage landscape. The following is a list of just a few of the new and potentially frustrating realities. They may not apply to everyone equally:

- Turn Times – If you’ve been through the mortgage process before, don’t expect things to happen as quickly this time around. High volume and quarantine-related operational hurdles are pushing turn times to extreme levels in some cases. A loan that took 15 days in the past could easily take 45-60 days now, depending on the specifics.

- New Hurdles and More of Them – Be prepared to see new guidelines and to jump through new hoops when it comes to getting final approval on your mortgage. Due to uncertainties created by coronavirus, the investors who buy mortgages generally want more information and more verification before writing checks. For instance, if you’re self-employed or derive income from rental properties, be prepared to share your life story with your mortgage company.

- You Might Not Qualify or The Rate Might Be Terrible – This may be the most ridiculous change if it ends up applying to you. Guidelines have changed massively in some cases. The costs associated with various aspects of a loan file have skyrocketed in some cases. If you have more than a few of those costly risk factors (things like investment properties, cash out, high balance, etc), you are likely not seeing the same all-time low rates everyone is talking about, and you may be lucky to even qualify in the first place.

If you’re in the mortgage process or you might be soon, you can avoid or minimize several of these frustrations by focusing on quick and accurate communication with your loan officer. Document requirements can seem onerous, but by providing everything requested, you’ll keep your file as far ahead as possible in what is already a very long line.