Mortgage rates are on a tear. As of this week, 2019 is now the best year in more than a decade in terms of the peak-to-trough move. But there’s a catch: 2019 isn’t over yet, and there’s always a risk that rates move higher between now and the end of the year.

So, will they (move higher)?

There are plenty of opinions on the future direction of rates, but there are NEVER any guarantees. All we can do is examine the available data and precedent in an attempt to understand what’s possible.

Things that build a case for lower rates

- Past precedent and market technicals

- Rates have been a bit lower in the past–both in 2016 and 2012.

- The yield curve (gap between 2yr and 10yr Treasury yields) inverted recently and some say that’s a harbinger of recession (and recession is good for rates)

- Rates have undergone an even bigger overall move from peak to trough in 2011/2012 (1st chart below)

- The super long-term trend in rates is still pointing lower (2nd chart below)

- US and Global market fundamentals

- The economic expansion in the US is now in record territory in terms of longevity. One school of thought suggests this makes it increasingly susceptible to a shift. Such a shift would generally coincide with downward pressure on rates (typical of most any economic downturn)

- Trade war uncertainty continues to promote safe-haven investments like bonds. Bond buying = lower rates

- European and Chinese economic data isn’t nearly as strong as US economic data. Global weakness has spillover effects that can benefit rates in the US.

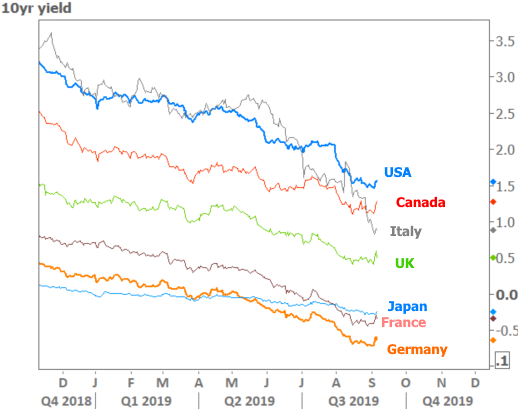

- Global central banks haven’t been shy about pushing much of the world’s supply of bonds into negative yield territory. Although many market participants are forced to buy the bonds of a specific country for certain reasons, investors who have a choice are obviously going to be more interested in keeping their safe-haven assets in the highly liquid Treasury market where yields are still in positive territory across the board. US 10yr yields are much higher than all G7 countries.

Things that build a case for HIGHER rates

- Past precedent and market technicals

- Sure, it’s easy enough to highlight the ONLY example in the past 16 years of a bigger move lower in rates, but compared to every other example, 2019 is the biggest and thus the most susceptible to a shift in momentum. In other words, big, sustained drops in rates only tend to go so far and last so long.

- Yes, the yield curve inverted, but past precedent suggests it could take 2 years for a recession to materialize in response. There also aren’t really enough past examples that have occurred in a low, stable rate environment to draw a convincing conclusion.

- Looking back at the 2nd chart above, notice the red dotted line. Yes, we’re technically still in the long term downtrend in rates, but we could also be seeing rates level-off and favor a more sideways trend from here.

- US and Global market fundamentals

- While it’s true the US economic expansion is long in the tooth, it’s also true that 2015 is seen by many as a “stealth recession”–one that effectively could have reset the expansion’s lease on life.

- While it’s true that foreign economies decelerated sharply in 2018 and 2019, the losses have been moderating and they may be bottoming out in terms of growth levels.

- While trade war uncertainty has been a huge motivation for rates to move lower, to whatever extent trade relations can be improved, rates could face some upward pressure as investors anticipate at least a token global growth rebound.

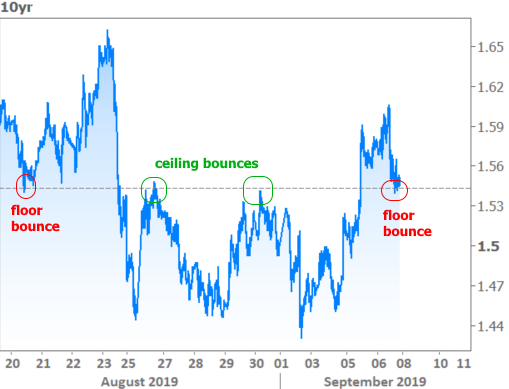

In terms of this week’s underlying market movers, we saw a fairly even split between trade-related updates and US economic data. The following chart breaks down the 3 most noticeable reactions in Treasuries. The first was a report citing China’s commerce minister saying that trade negotiations were set to resume in October. The biggest single uptick in bond yields followed Thursday’s exceptionally strong ISM Non-Manufacturing report. But bonds were able to recover a bit on Friday after the Jobs report missed expectations.

To be fair to the bond market and the jobs report, it was really only the outright job tally that was weaker than expected. The unemployment rate held at 3.7% despite more workers entering the labor force, and average hourly earnings beat forecasts on a monthly and annual basis. All told, if bond traders were determined to trade rates higher, this report wouldn’t have prohibited that. So the fact that rates recovered a bit is somewhat reassuring.

The other way to look at the point above would be to say that bonds have now pivoted above the high yields seen at the end of August and refused to break back below those levels after Friday’s jobs report. In other words, perhaps the ceiling is once again becoming a floor…

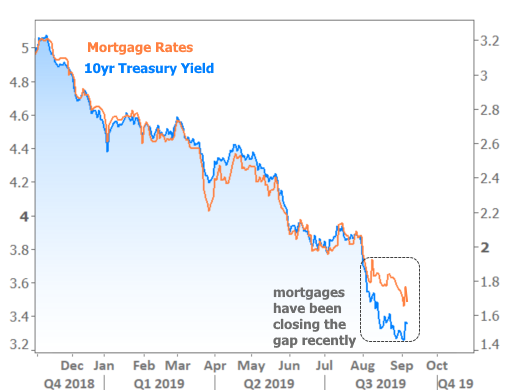

Ultimately though, unless next week brings a high-conviction move, we’re likely waiting for the mid-September Fed announcement before we get a clearer idea about the next phase of momentum in rates. For now, anyway, mortgage rates have greatly enjoyed a bit of sideways weakness in Treasuries. Up until the past week and a half, they couldn’t keep up. Now they’re closing the gap!