Mortgage rates ended the week at the highest levels in roughly 2 months as investors moved to the sidelines ahead of next week’s Fed announcement.

In other words, investors sold bonds (among other things) and in the bond market, selling pressure means lower prices and higher rates, all other things being equal.

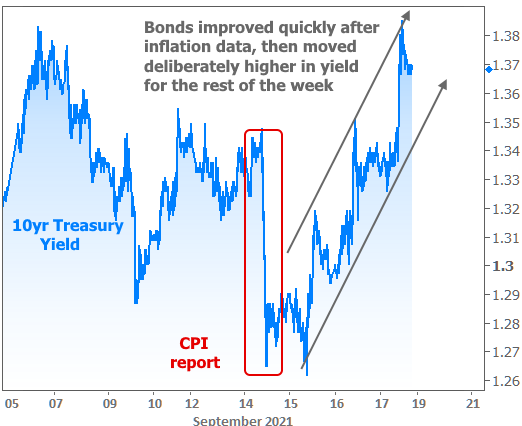

Despite the poor finish, things started out well enough. The Consumer Price Index (CPI), a key inflation report, came out lower than expected on Tuesday. With inflation being an important consideration for the bond market at the moment, the reaction was obvious. Unfortunately, it was also short-lived.

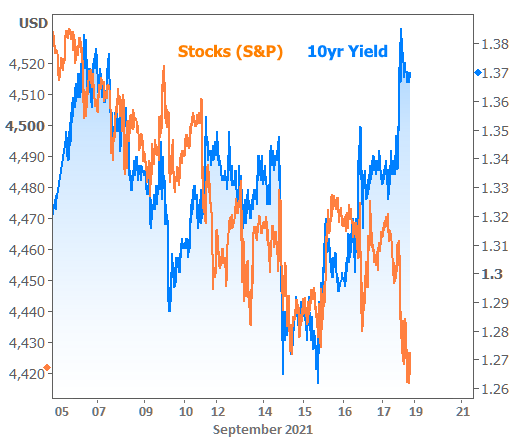

If we add S&P futures to the chart above, we can see that stocks were also generally moving to the sidelines (i.e. more sellers than buyers).

While there is never one singular motivation for stocks and bonds, they definitely share a concern for Fed policy. With next week bringing an important policy announcement from the Fed, it would make sense to see investors circling the wagons in preparation.

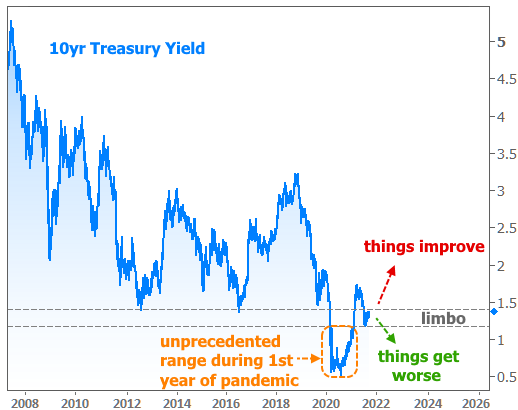

With a specific eye on the bond market, this preparation has arguably been going on for some time. The result is the consolidation pattern seen in the following chart. The green line simply marks the calendar date of next week’s Fed announcement.

In the chart above, the inception of the pattern is no coincidence. It began after the strong jobs report in early August. The labor market is a key consideration for the Fed, and some Fed members were on record saying it would only take one more report like the one in early August to justify a shift toward tighter policy (i.e. not good for rates).

The next report arrived on September 3rd and once again, rates pushed up to the near-term ceiling marked by 10yr Treasury yields in the 1.37-1.38 range. Now at the end of this week, we’re back at the same ceiling levels.

Bonds haven’t been eager to break that ceiling because the conditions that warrant more austerity from the Fed haven’t been met yet. Chair Powell has said on many occasions that the labor market has more progress to make before the Fed will begin to taper its rate-friendly bond purchases.

In addition, the Fed would like to see how covid and the economy are interacting after the start of the new school year, and it’s just a bit too soon to draw any sweeping conclusions.

The longer-term chart conveys the sense of limbo for rates (10yr Treasury yields are widely used as a benchmark for other rates like mortgages). They’re neither in the ultra-low zone associated with the first year of the pandemic, nor are they back into the pre-covid range. That said, they’re likely to pick a side in the coming weeks–perhaps as early as next week.

In other news this week, the FHFA and Treasury made a big announcement that affects certain mortgage scenarios. This goes back to earlier changes that we discussed in previous newsletters HERE and HERE. The biggest impacts were seen in loans for investment properties and 2nd homes.

To make a long story short, the regulatory changes (which forced many lenders to raise rates significantly for those loans) have been rescinded for at least a year. The implication is that those lenders can begin lowering the cost for those loans. The timing and magnitude of that process will vary depending on the lender. Either way, please be sure to note that this does not impact a vast majority of mortgages tied to owner-occupied properties.