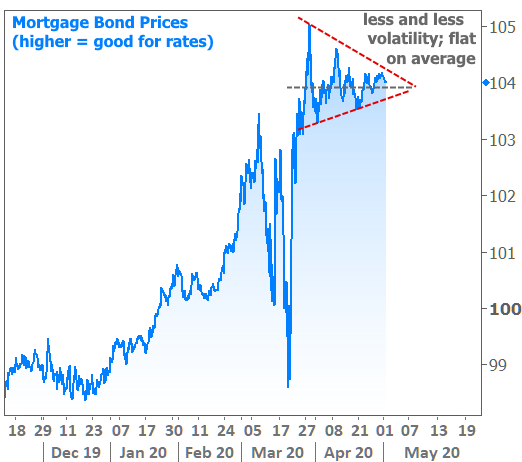

Investors buy and sell groups of mortgages that are pooled together in mortgage-backed bonds. The price an investor is willing to pay for a mortgage bond is the primary factor in determining mortgage rates. As demand for these bonds increases, rates fall (all other things being equal).

As is the case for other types of bonds, such as US Treasuries, investor demand tends to increase when the economic outlook is bad because bonds offer safety. Investors give up big potential gains in exchange for low, stable rates of return.

Given the unique economic circumstances surrounding coronavirus, investors didn’t have to wait for official data to tell them the economy was in trouble. As such, they were able to get in position early and quickly. This means bond prices have been relatively flat at extremely high levels for weeks and weeks.

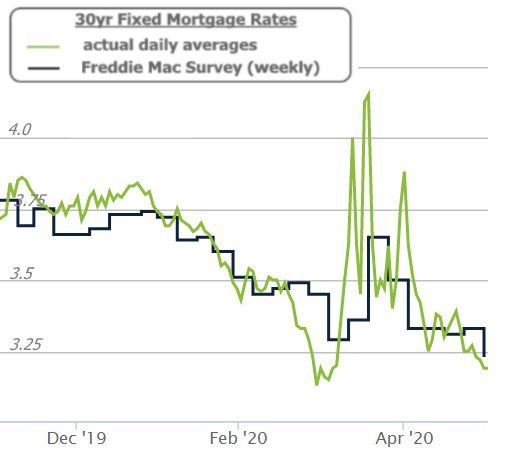

The nice thing about mortgage bond prices being high and stable is that mortgage rates have been low and increasingly stable. But are they as low as they should be? Unless we dig a bit deeper, all the casual observer can see is that rates are at all-time lows according to multiple sources on Thursday. Critically though, the stories in question were citing Freddie Mac’s weekly survey-based rate data, which has a notoriously hard time capturing day-to-day changes. As far as actual daily averages are concerned, we’re not yet back to the all-time lows seen in early March, even though some lenders are close.

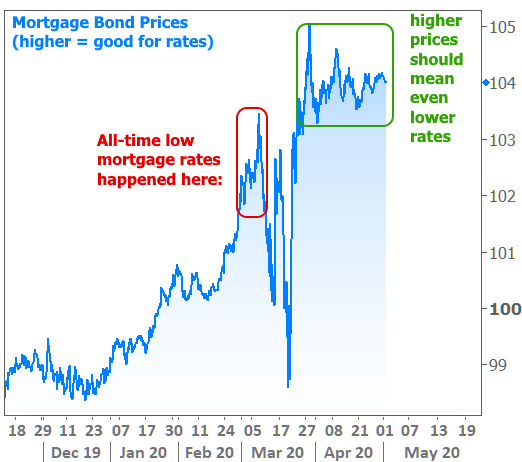

But remember the first chart? Let’s revisit it and highlight the time frame that saw the all-time low mortgage rates.

So how is it that prices are even higher now, but rates are not significantly lower?

In a word: coronavirus. The pandemic and the official response from policymakers have created an environment with more homeowners seeking forbearances than even the most dire stress tests could have predicted. That’s causing big problems for the value associated with mortgage servicing and lenders’ margins. These components of the mortgage rate equation exist independently from the mortgage bond prices referenced above.

Servicing valuations and margins typically don’t move enough to merit much attention. But now, they’re accounting for most of the volatility seen in the past month and ALL of the mysterious gap between actual rates and those implied by mortgage bond prices.

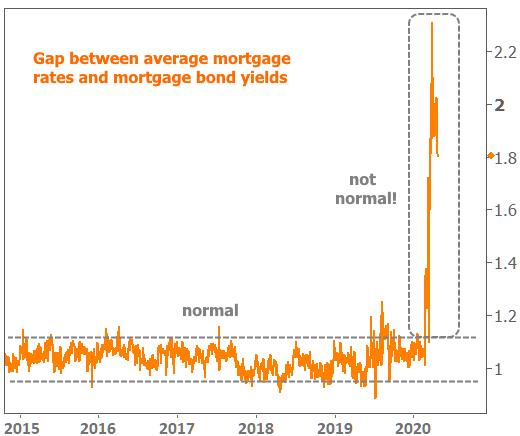

And what exactly are mortgage bonds implying? The following chart shows the gap between the average 30yr fixed rate and mortgage bond yields. It was recently twice as wide as normal. Even after calming down a bit, it remains at least 0.75% higher than normal. In other words, a 3.25% mortgage rate today would be 2.5% without the forbearance situation.

What does this mean for you? What does it imply for rates in the coming weeks?

Lenders/investors are starting to calm down about forbearance risks as the bigger picture becomes clearer, but that process has a cost. In order to calm down, investors have been forced to shun the loans at more risk of entering forbearance (or simply those that would be the most costly for investors in the event of forbearance).

This is having an inordinate impact on loans that are outside the box in terms of top tier qualifications. Whereas a normal 30yr fixed refi with a top tier scenario is seeing the lowest rates since early March, a borrower with a lower FICO seeking a cash out refi is seeing staggeringly high costs by comparison. In many cases, lenders are simply saying “sorry, we’re not doing those scenarios currently.”

The increased costs and decreased credit availability will continue to be an issue for the mortgage market. Many lenders will end up tightening guidelines further before they begin to relax them. While rates may continue to improve for top tier scenarios, things may get worse before they get better for many others. We’ll need to see how big the forbearance issue becomes and how much damage it causes before mortgage pricing and availability starts to behave in a more historically logical way.