Coronavirus has brought chaos to financial markets like few other things have. Much of the fallout is unprecedented. This is especially true for interest rates and the mortgage market. In many ways, things are more chaotic now than they were in 2008. That has positive and negative implications. Here’s what you need to know.

Market Impacts

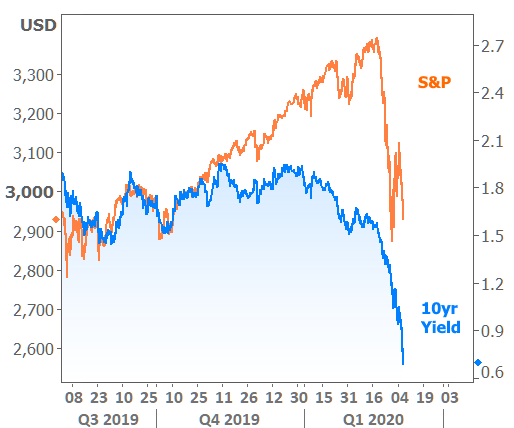

Stock losses have been massive. That’s no great secret for anyone who watches the news. Notably though, stocks have merely moved back into 2019’s levels. Things are very different in the bond market where the 10yr Treasury yield has surged repeatedly to new all-time lows over the past week and a half.

1.321% had been the longstanding all-time low from 2016. At the time, it represented only a small break below the previous floor of 1.381. By Friday morning of this week, 10yr yields hit 0.66% and remained under 0.80% for the entire day. Such levels bordered on the unfathomable as late as last week even as the 10yr was already moving into all-time lows at a record pace.

Downward movement in bond yields can indicate fear in financial markets, among other things. When that fear is sudden, unexpected, and massive enough, it not only makes for truly huge changes in bonds, but it can also elicit an emergency response from the Federal Reserve (as it did in 2008). This time around, markets had begun to expect a 0.50% rate cut from the Fed, and that’s exactly happened on Tuesday morning.

Fed Funds and Mortgage Rate Impact

Many homeowners heard about the cut to the Fed Funds Rate and assumed it meant they could get a lower mortgage rate. What’s more, in a horrible display of journalistic irresponsibility, some of the biggest media outlets (even those specializing in housing news) ran stories suggesting lower mortgage rates as a result of the Fed rate cut. Nothing could be farther from the truth.

The Fed’s rate doesn’t dictate any mortgage rates apart from home equity credit lines. While it often moves in the same direction as the traditional 30yr fixed mortgage rate in the long run, there are months and even years of time when they seemingly have nothing to do with each other.

This makes sense for a few key reasons. The Fed Funds Rate is a different animal than the mortgage rate. It applies to loans with a term of up to 1 day. That’s a far cry from the average mortgage, and investors approach those loans with completely different sets of priorities. That’s why we sometimes see longer and shorter term rates move in OPPOSITE directions (which accounts for the “inverted yield curve” phenomenon that made news in 2019 when 10yr Treasury yields were lower than all of the short-term rates under 2 years, including Fed Funds).

But even if long and short term rates always moved in the same direction, there’s an even more important reason that mortgage rates might not follow the Fed. The bonds that dictate mortgage rates trade thousands of times a day. Mortgage lenders themselves update their rates at least once a day. In contrast, the Fed only meets to consider changing its rate 8 times a year, barring emergencies (like Tuesday). This means mortgage rates can and do move well in advance of Fed rate changes. Indeed, the behavior of longer-term rates like mortgages can often predict the market conditions that prompt the Fed to make a move.

Bottom line: the bond market (which includes mortgages rates) has been able to react to coronavirus implications for weeks, and there’s been no Fed meeting during that time. It took an emergency, unscheduled rate change for the Fed to even bring itself into line with market expectations. They’re a battleship in a river, and that river has been swift. If you need more convincing on this particular point, here is a more detailed conversation.

Treasury vs Mortgage Rate Discrepancy

If we add together people who believe the Fed controls mortgage rates and those who believe the 10yr Treasury yield is in charge, we account for a vast majority of opinions on the matter. We also collect a large supply of faulty assumptions.

While it’s true that the 10yr yield is vastly superior to the Fed Funds Rate when it comes to benchmarking mortgage rates, it doesn’t have the final say. This was discussed exhaustively in last week’s newsletter (please read it if you don’t already understand why Treasury yield trends don’t always match up with those seen in mortgage rates).

Mortgage Market Chaos Unleashed

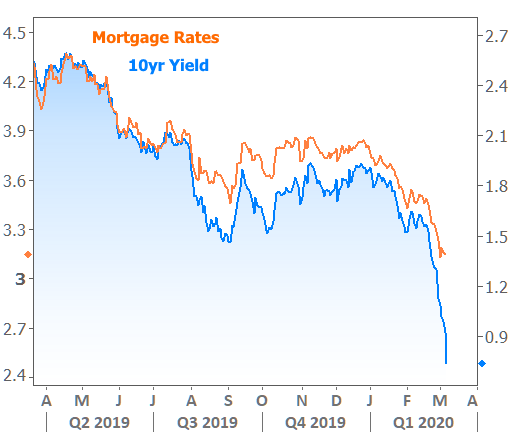

The Treasury vs Mortgage discrepancy went from bad to worse this week. Here’s a chart of actual mortgage lender averages versus the 10yr Treasury yield.

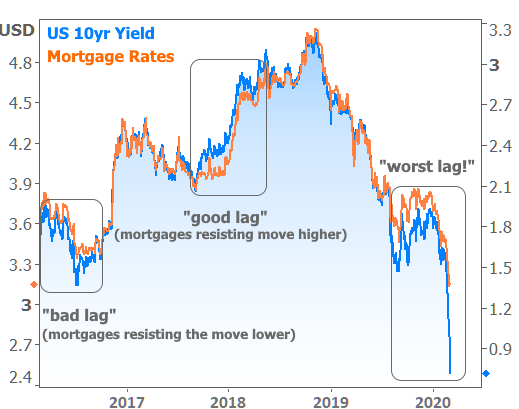

To give you an idea of how reliable this relationship CAN BE, here’s a longer-term chart (with a few other instances of mortgage rate movement lagging behind Treasury movement, for better or worse).

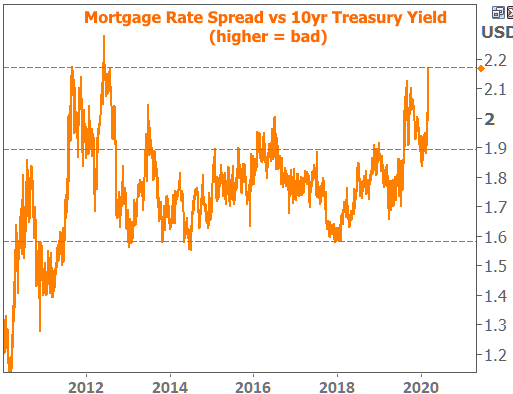

And here’s a chart with a single line that measures the distance between the two rates over time. This is the biggest gap since the last time 10yr yields dropped the way they’re dropping now (again, if you’re reading this and aren’t sure why Treasury yields are capable of moving higher or lower so much more quickly than mortgage rates, please revisit last week’s newsletter by clicking here).

Yet despite all those headwinds, mortgage rates finally and officially moved to new all-time lows this week. On one hand, that’s great news! On the other hand, it’s made a complete mess of the mortgage market. Demand has ramped up in a way that many lenders have never experienced. Some of them have taken to RAISING rates in order to deter new business. Others have completely stopped accepting new applications. In almost all cases, the turn times to accomplish a simple refinance are as high as they’ve been. And if you happen to need a full appraisal (as opposed to a Property Inspection Waiver), your lender may not have a long enough rate lock time frame to accommodate you.

Fortunately, the big blowout between mortgage rates and Treasury yields means the window of opportunity should remain open long enough for homeowners to calm down and take their time when it comes to locking and moving forward. Depending on rates, time frames, and risks, different strategies may make sense for different borrowers. The only thing that should be a part of any strategy is to make a plan of attack with your mortgage professional. Get on the same page about turn times, lock windows, and rates. And please… for all the reasons discussed above, understand that mortgage rates may indeed be flat to higher on any given day, even if Treasury yields are lower and even if the Fed just cut rates again.