There are several major developments in the mortgage world recently, and they’ve generated a bit of confusion. So let’s clear it up!

I heard rates were 1.99%. What’s up with that?

Ever paid more upfront in exchange for lower cost over time? 1.99% is that simple, and it was aggressively/cleverly marketed. When comparing options side by side, the average borrower tends to choose a higher rate over the bigger upfront costs associated with 1.99%. A previous newsletter discussed this in much greater detail HERE.

I heard there was some fee a few weeks ago that made mortgage rates 0.5% higher!

Sort of… Remember, mortgage rates themselves are only one part of the equation. There’s also the option of paying more or less upfront to make that rate higher or lower. In fact, whether you see it or not, there’s an upfront cost attached to every rate that’s quoted. The 0.5% fee applied to that upfront cost, NOT the interest rate itself. The ratio between the two is such that 0.5 UPFRONT COST is roughly the same as 0.125% in interest rate.

So you’re saying rates went up 0.125% a few weeks ago?

No, actually, they went up quite a bit more for the average lender–largely because lenders were spooked, for lack of a wordier explanation (did you really want one?). Lenders were also going to be forced to pay that 0.5% fee on loans that were already locked (i.e. they couldn’t charge those borrowers any more than they’d already agreed to charge, so they were forced to make up the difference on new loans).

I heard that 0.5% fee was delayed this week, so now rates are down 0.5%?

No… rates were down 0.125% in some cases after the announcement of the delay. They wouldn’t go down 0.5% because 0.5% refers to the upfront cost side of the equation, and again, 0.5% in upfront cost equates to roughly 0.125% in terms of rate. Markets and rates have also moved in both directions since the delay was announced.

If it helps, think about upfront costs in terms of the word “points.” 1 point = 1% of the mortgage amount. Points are sometimes paid to bring interest rates down, as in the 1.99% example above. The refi fee was (and will be) 0.5 points. And 0.5 points equates to roughly 0.125% in terms of interest rates.

What if I locked my loan after that fee was announced?

Most lenders are automatically adjusting your loan quote to remove the fee. PLEASE NOTE, as described several times above, the fee that’s being removed is 0.5% OF UPFRONT COST (0.5 points) which roughly equates to 0.125% IN TERMS OF RATE.

What if I locked BEFORE this fee was announced (i.e. before 8/12/20)? Where’s the love for me?!

There is no love for you–at least not in terms of your locked rate getting better (though if you’re savvy enough to be reading this newsletter, you are undoubtedly loved). If you locked before 8/12/20, you never paid the fee in the first place. If you were NOT locked (aka floating), current rates are current rates. The delayed fee will not be factored into those rates until lenders put it back into place.

Good point! When is the fee being put back into place?

The housing agencies delayed it until Dec 1st. But that applies to loans that have closed and been sold to the agencies by Dec 1st! Depending on the lender, this means your loan would need to close 2-6 weeks prior (mid-October to mid-November). Several lenders have already published guidance saying a loan must close by Nov 1st. Others are simply collecting the fee and pledging to credit it back if the loan is sold in time. Yes… this is all kind of a mess.

OK, forget that fee… I heard the Fed promised low rates forever this week. How do I get in on that?

The Fed did SOMETHING this week, but they didn’t do that. The Fed updated its policy framework–a set of basic principles that guide its policy decisions. The big news here was a bump to their longstanding inflation target of 2.0%. In essence, they’d like to get it up in the 2.0-2.5% range for a while to offset time spent well under that in the past few decades.

Inflation might sound like a bad thing at face value, but the Fed operates under the assumption that a low, stable rate of inflation yields the best combination of economic growth and employment opportunities. They pursue their inflation goals by lowering their interest rate (among other things). Cheaper money encourages more money to be spent and, thus, inflation. That’s the idea anyway.

By saying they’d be willing to let inflation drift up above 2.0%, the Fed is essentially saying they will keep cheap money flowing a bit more freely and for a bit longer than normal as the economy bounces back from the covid-inspired contraction.

Ah ha! So the Fed DID promise lower rates for longer!

If you’re talking about the Fed Funds Rate, sure… you could make that argument. But it’s important to remember the Fed Funds Rate has essentially nothing to do with the mortgage market on any given day.

The Fed Funds Rate applies to loans that last less than 24 hours. Mortgages, obviously, can last up to 30 years. Loaning someone money for 24 hours is VERY different than 30 years (or even the 5-10 years that the average mortgage lasts). That’s why these rates have always been very different in practice. For instance, the Fed Funds Rate was pinned at 0-0.25% for years after the financial crisis. Meanwhile, mortgage rates moved up, down, and sideways, never dropping below 3%.

If anything, this week’s update from the Fed is arguably BAD for longer-term rates like mortgages. Inflation is historically the enemy of low rates, and the Fed is doubling down on its commitment to generate more inflation. Unsurprisingly then, rates moved decidedly higher on the day of the Fed’s announcement.

In fact, there’s a risk that the market treats this as a cue to try to push longer term rates back up to the levels seen in early June. Combine that with the impending re-introduction of the refinance fee and there should be a real sense of urgency for those considering getting a mortgage.

So you’re saying rates are about to go higher, not lower?

Anyone who pretends to know where rates are going to be in the future is naive, lying, trying to sell you something. Rates take cues from multiple inputs and the key input is the bond market. If there was a way to know what the bond market was going to do ahead of time, it would be exploited by traders, the market would “break,” and the secret knowledge would be worthless. Everyone thinks they know the future at some point in their market watching careers, but the smartest rate watchers are the ones who know they have no idea. There are very limited exceptions to this wisdom. We’ve arguably only seen it a handful of times in the last 15 years and right now is not one of those times.

There are reasons we could argue that rates will stay low and drift lower, but they depend on variables in epidemiology and macroeconomics that are just that: VARIABLE. Even then, situations like the August 12th fee announcement and Thursday’s update from the Fed go to show that short term surprises greatly outweigh the bigger picture probabilities when it comes to the average decision time frame for a prospective mortgage borrower.

This topic deserves a whole Q and A unto itself, but here’s the gist: If you’re trying to decide if now is the time to refinance, then you should simply consider your current mortgage versus the proposed mortgage. If you’ve had your existing mortgage for years and worry about resetting the clock, be sure to ask your mortgage professional to help you compare your current payment to the new refi quote where you continue making the exact same payment (with the overage paying down principal). The average homeowner tends to see sufficient benefits when they can drop their current rate by at least half a percent.

I already know I can save half a percent, but do I lock now or wait a bit?

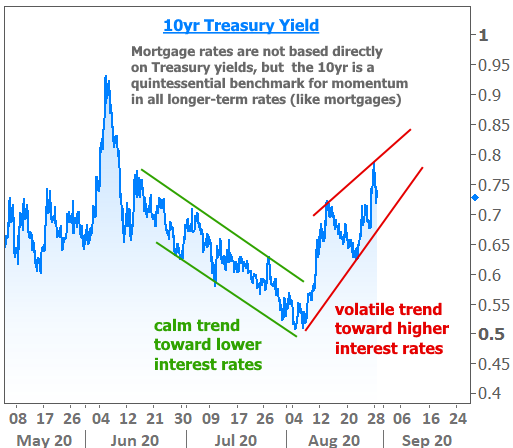

Hindsight is 20/20 when it comes to lock timing. We know the refi fee will be back in play in a matter of weeks (or sooner for some lenders), so that’s a great argument to act sooner rather than later. We’re also seeing some signs that the bond market may have already traded its lower-rate mentality from June/July for a more cautionary move toward higher rates in Aug/Sept.

But again, there’s no way to know how September will evolve. The best bet for a prospective mortgage borrower right now would be to make sure your loan is 100% ready to lock and to make sure you have a game-plan in place with your mortgage professional.