This week’s policy announcement from the Federal Reserve (aka “The Fed”) was hotly anticipated. In the past month and a half, traders have rapidly upped their bets on multiple Fed rate cuts in 2019 as trade tensions flared. Softer economic data only added fuel to the fire.

In other words, markets think they see a reason for a big shift in Fed policy and this was the Fed’s first official policy announcement since the most recent bout of drama began.

Why is the Fed’s take so important? Simply put, Fed policy is a critical component underlying global market movement. It’s not that the Fed can dictate long-term market trends, but they can definitely accelerate or delay existing trends, and create a ton of volatility in the process.

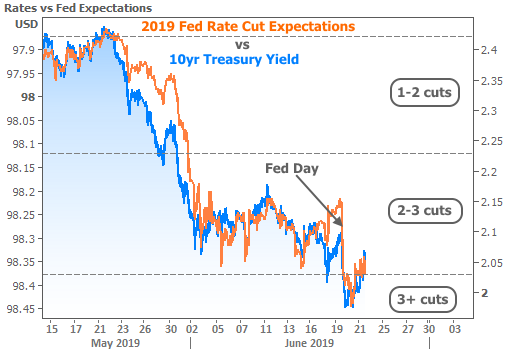

This is more true in the interest rate world than anywhere else. In fact, Market expectations for Fed rate changes tend to trace day to day movements in actual interest rates. This can be seen in the following chart of 10yr Treasury Yields and Fed Funds Futures (where speculators bet on changes in the Fed Funds Rate).

The chart shows rates falling on Fed day only to bounce back to pre-Fed levels by the end of the week. This tells us the Fed did a pretty good job of confirming rate cut suspicions without sending markets into a panic.

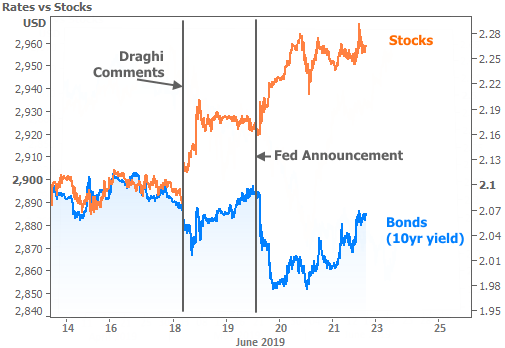

This is true for stocks as well as bonds. Both sides of the market enjoy the promise of easier monetary policy from central banks in the event any economic weakness takes root. The European Central Bank (ECB) proved that concept a day before the Fedas ECB President Draghi said that additional stimulus and rate cuts were likely. In both cases, the market reaction is obvious.

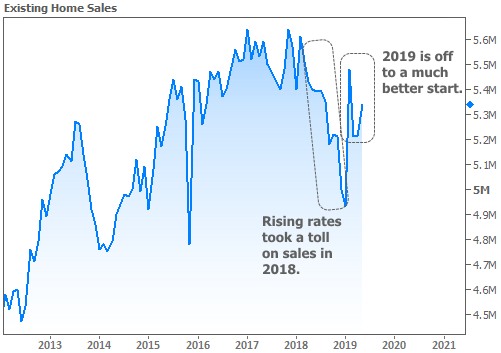

The housing market also has an obvious appreciation for lower rates, but with a far slower reaction time. While we can see the broader decline in rates having a positive impact on home sales so far in 2019, we can only speculate as to additional gains that may follow if the average 30yr fixed rate continues to operate below 4%.

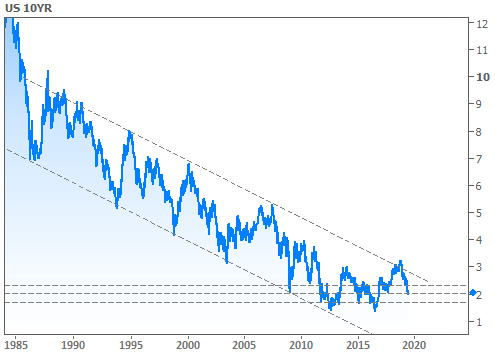

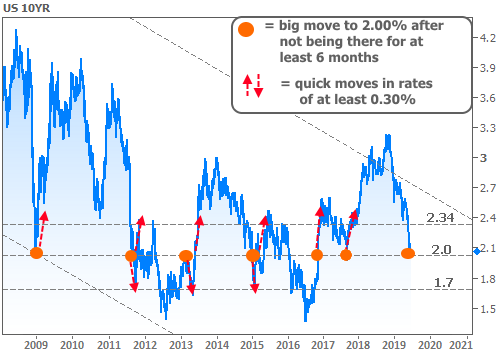

So what’s “the catch” mentioned in the title? If there’s one key takeaway from this week’s Fed announcement and the broader decline in rates in 2019, it’s that we should expect additional volatility ahead. In the past, when 10yr Treasury yields (the best benchmark for momentum in longer-term rates like mortgages) make big moves down to 2.0%, we tend to see the next .30% follow quite quickly (often in both directions).

Bottom line: by confirming the market’s hopes for potential rate cuts, the Fed is also confirming a high stakes game. The major economic reports in the first week of July will be especially important as they’ll have a chance to justify or cast doubt on the massive shift in rate cut expectations. Volatility would only be compounded by the fact that markets are closed on Thursday for Independence Day. There’s no way to know ahead of time which way rates would move, only that they could move quickly.

Until then, enjoy the fact that rates are now back inside the decades-long bull market that was apparently defeated in 2018 (same diagonal lines from the chart above):