The Federal Reserve (aka “the Fed”) released its latest policy announcement this week without making any changes to existing policies or rates. The Fed doesn’t directly control mortgage rates, but Fed policies–and even the verbiage of the announcement–can have an impact on ALL rates.

This time around, the market’s biggest concern was that the Fed would take another step toward “tapering.”

What is tapering and why does it matter?

In the pursuit of its policy goals, the Fed buys US Treasuries and mortgage backed securities (MBS). Treasuries serve as a reference point for most of the lending that takes place in the US. By buying both, the Fed ensures rates are low in general and that mortgage rates are as low as they can be.

As the pandemic grew more manageable and especially as the economy has come back online, the Fed has increasingly discussed winding down (or “tapering”) the bond buying programs. When the market thinks (or knows) tapering is on the table, rates are at risk of moving higher.

The same thing happened in 2013, only the market was much more surprised by the taper talk. This time around, the market fully expected it. In fact, much of the increase in rates (especially Treasury yields) seen between August 2020 and March 2021 was an effort to price in the eventual taper.

Markets may have gotten a bit ahead of themselves in that regard. While this is understandable given the traumatic taper tantrum of 2013, the Fed has been surprisingly steady-handed this time around.

In a press conference following the announcement, Fed Chair Powell clarified the economy is still “a ways away” from the level of progress required to actually pull the trigger on tapering. Whereas some economists thought we’d see such a trigger pulled as early as September, Powell gave the impression that the discussion would carry on for at least 2 more Fed meetings. That puts an announcement off until November at the earliest–possibly later–with tapering probably not commencing until early 2022.

In addition to that slower decision-making process, Powell also addressed MBS specifically. He acknowledged that several Fed members wanted to taper MBS before Treasuries, but that they were the minority. At worst, it sounds like the Fed might consider tapering MBS and Treasuries at different paces–still a victory compared to an “MBS first” scenario.

All of the above has allowed the bond market and, thus, mortgage rates to remain at the strongest levels since February.

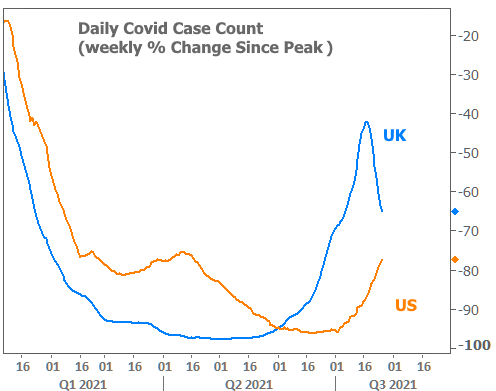

As long as covid cases continue to surge, rates should be able to avoid too much volatility. If other countries’ experiences with the delta variant are any indication, we’re measuring this time frame in weeks as opposed to days.

Still, next week brings bigger risks with several important economic reports culminating in Friday’s official jobs report.