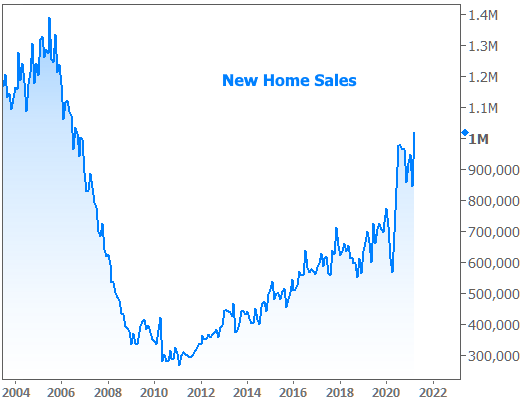

This week’s New Home Sales report (for the month of March) stole the show, coming in over 1 million for the first time since 2006.

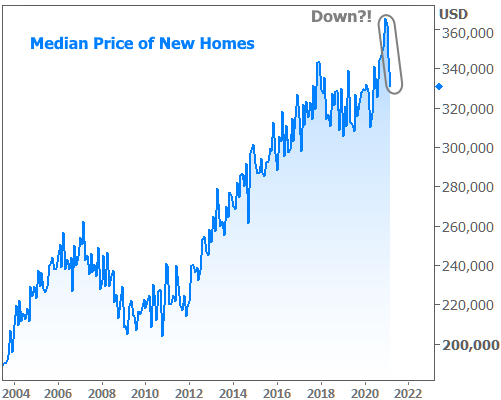

But although sales are up 66% year-over-year, prices have fallen in recent months and are now basically unchanged from last year. What’s up with that?

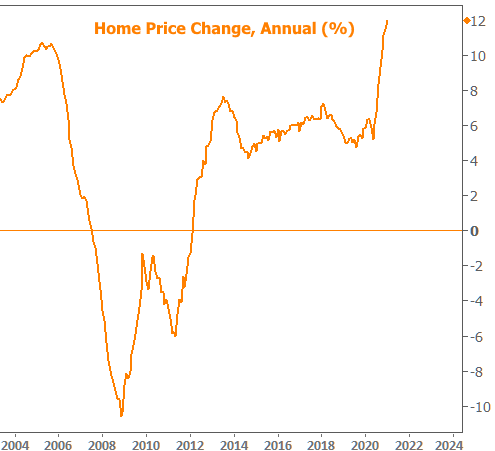

Making this all the more puzzling (at first glance, anyway) is the fact that home price appreciation has been breaking records according to some reports. Here’s the widely-followed FHFA House Price Index:

FHFA’s data is for REPEAT sales and refinances. That means it doesn’t capture new home prices at the time of construction despite thoroughly tracking home prices in general.

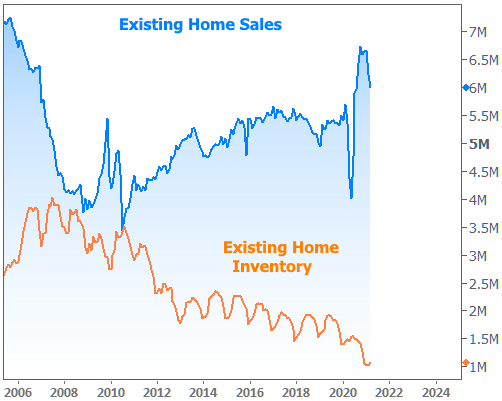

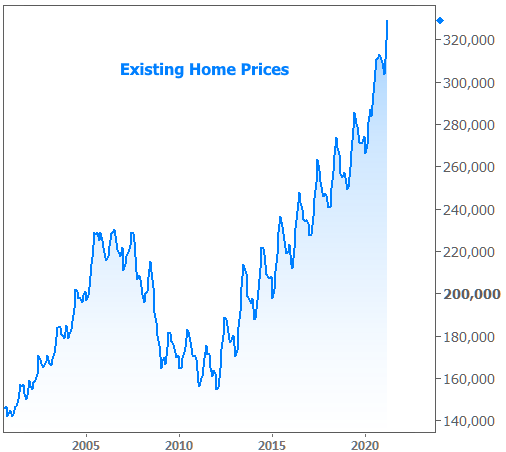

There’s a separate home sales report for “existing” sales, and it does a better job tracking with FHFA’s home price trends. Fortunately, that report also came out this week. In some ways, it caused the plot to thicken.

Unlike New Home Sales, Existing Homes Sales fell in March and are now noticeably below levels seen at the end of 2020. Record low inventory is the primary reason.

As you might expect, when home sales are falling due to inventory constraints, we shouldn’t be seeing any downward pressure in prices. Indeed, existing home prices easily smashed their previous record (set last month).

One can’t help but notice the rhythmic regularity in the existing home price chart. This is another huge clue in solving our new home price mystery. It suggests that new home prices must be diverging from the broader trend for their own reasons (i.e. something specific to the new home market). Reason being: existing homes comprise a FAR larger portion of the housing market. And because existing homes already–well–exist, their price trend is significantly less affected by changes in buyer preferences or builder offerings.

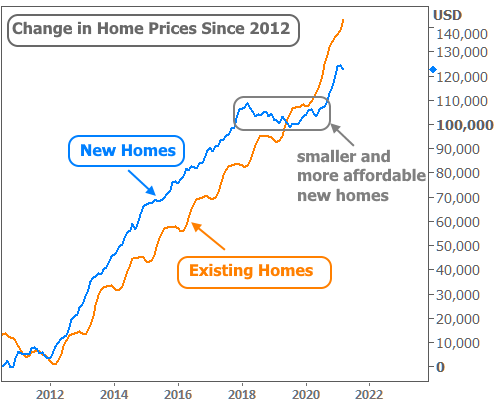

At last we come to the answer. There is indeed something about new homes causing prices to fall. In a word: SIZE. The median home is almost 200 sq ft smaller than it was in 2017, and, as anyone who has shopped for a home recently knows, lot sizes have shrunk even faster. The net effect is an average new home that is smaller and more affordable.

The price chart above would show an even bigger contrast were it not for material prices. Lumber is in the insanity zone, up more than 300% since the start of the pandemic. Experts disagree on when the madness will end and what sort of recovery we may see.

Persistently low interest rates continue to help offset high material prices. They also benefit existing and new home prices equally. 2021 had been an unpleasant year for interest rates up until April. And it wasn’t until last week that rates really distanced themselves from recent highs seen at the end of March.

This week was another good one for rates, with the average lender back down to the lowest levels in almost 2 months. 10yr Treasury Yields (the most widely-followed benchmark for longer-term rates like mortgages), have been well-behaved in their move lower. The next milestone would be a break below 1.53%–a level that served as a floor both this week and last.

The continuation of this friendly trend depends on several factors. While everyone loves a good prediction, they’re tricky business–especially when they pertain to the future. Even if someone is right about rates going lower, they might not be right about the timing or magnitude of the move.

What we can know is that over the longer run, rate levels will be determined by the health of the economy, the state of the pandemic, inflation, and the level of new debt issuance (used to pay for things like covid relief and infrastructure). Since we don’t really know how everything will shake out, we have to assume there are several potential outcomes ranging from “moderately lower” to “significantly higher.”

Granted, if rates move significantly higher, it wouldn’t be overnight, but it’s important to understand lessons from history. They provide 2 clear, recent examples of how long a “rising rate environment” can last, and how much ground it can cover.