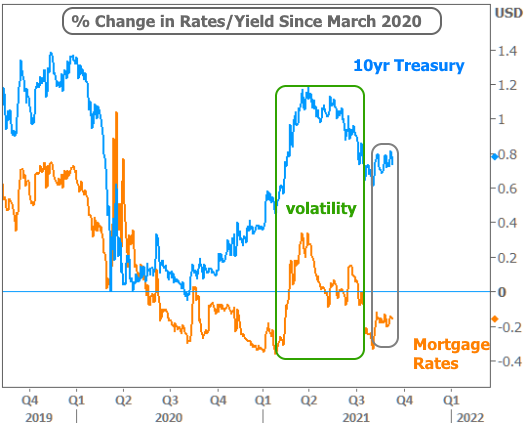

Rates are dictated by the bond market and bonds are flashing a warning sign about volatility on the horizon. In other words, rates look like they’re ready to make a bigger move in the near future, for better or worse.

This isn’t readily apparent at first glance–especially when it comes to mortgage rates (which are still very close to all-time lows). Even when we look at a rate benchmark like 10yr Treasury yields, it seems that volatility has died down recently.

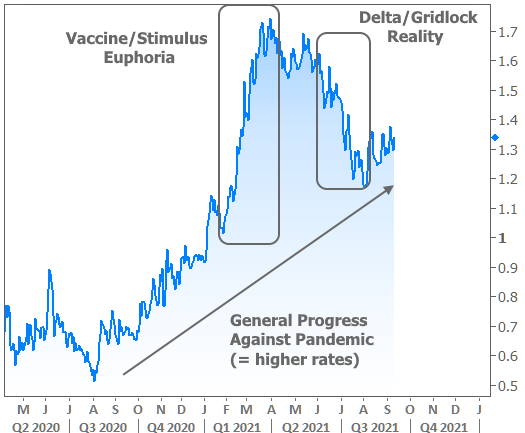

But the absence of volatility is actually the problem. Rates had been moving decisively higher early in the year as vaccines and fiscal stimulus fueled hopes of a quicker economic recovery. More recently, political gridlock and the delta-driven surge in covid cases took 10yr yields back in the other direction.

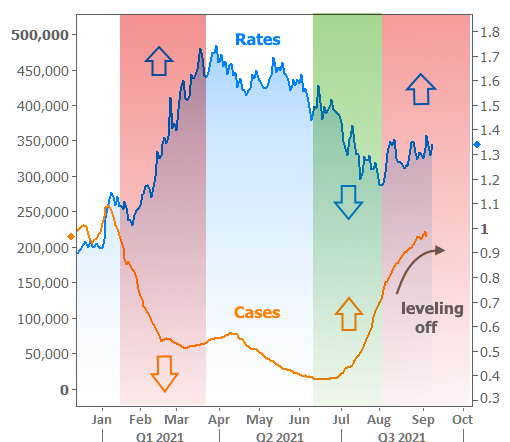

Covid numbers are the first part of the warning. The growth in case counts is leveling off. This could be part of the reason that the trend toward lower rates has subsided in the past month. Rates and case counts have had a generally inverse correlation:

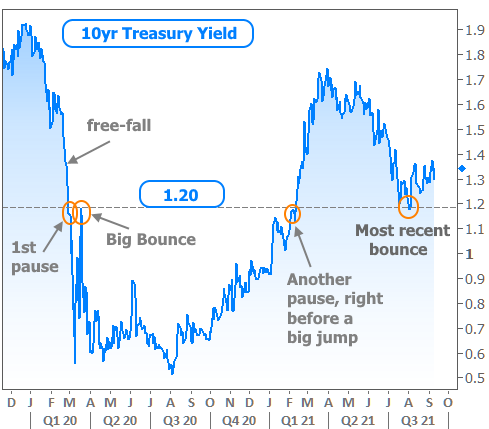

The bounce in rates is also occurring at an important level (1.20% in 10 year yields). As the following chart shows, this was the first level where rates paused when they were in free-fall at the start of the pandemic. It then marked the ceiling that blocked the only attempt to move significantly higher in 2020. Then in 2021, it was the last place that rates paused before their biggest post-covid surge.

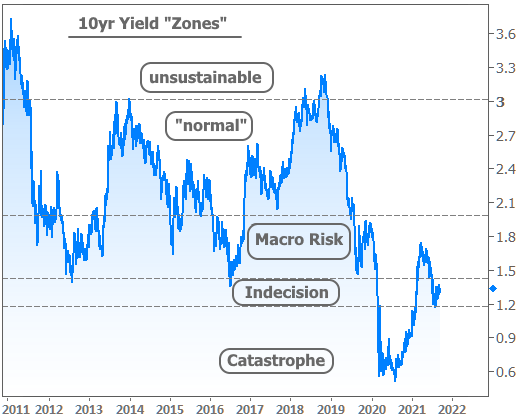

Zooming out to a very wide view, we find that current Treasury yields are in the desert, so to speak. This is the first time they’ve ever spent more than 2 weeks in this zone (referred to below as the “indecision” zone). Yields could rise quite a bit and still be considered historically low.

The “macro risk” zone highlights the times where the global economy faced bigger challenges in the past decade and it would be no surprise for rates to convalesce there if the covid situation progressively improves.

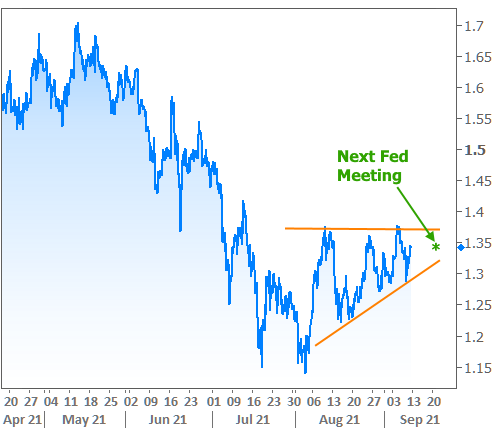

Perhaps more importantly, that same improvement would render rate-friendly Fed policies obsolete. Incidentally, there’s a fairly important Fed meeting coming up in 2 weeks, and it coincides almost perfectly with the consolidation in rates.

In other words, the compression of the rate range is like the compression of a spring. The only catch is that we don’t know if it’s being pushed against a ceiling or a floor. Generally speaking, if we get past this phase in covid (schools stay open, more people go back to work, case counts start dropping, etc), rates would most likely be springing higher.

If there’s a covid resurgence and the labor market refuses to recover as fast as previously hoped, rates could easily move back to the recent floor marked by 1.15% in the chart above (which equates to the mid 2% range for best-case-scenario mortgage rates).

A few side notes…

The Fed isn’t the only game in town, and even if they were, their decisions depend on inflation and the labor market. Some people are very concerned about inflation, but the Fed maintains that current price pressures are most likely temporary side-effects of supply constraints. In other words, covid messed everything up and it will take some time for things to settle down. To their credit, the Fed admits they could be wrong, but assures us they have the tools to address that eventuality, if needed.

Fiscal policy is also a consideration. Fiscal spending implies the need for revenue or Treasury issuance. Treasury issuance creates additional “supply” in the bond market, and like anything else, higher supply means lower prices. Connecting the dots, lower bond prices mean higher rates/yields.

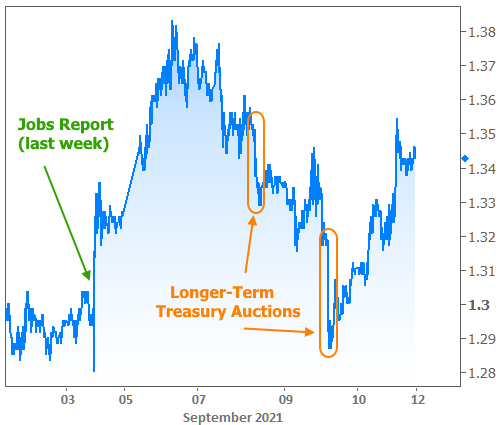

The market’s concern over Treasury supply is constantly playing out in trading levels. This week offered a fresh example during the scheduled Treasury auction cycle. There were 2 longer-term auctions (Wed & Thu). Together, they accounted for more market movement than last week’s jobs report (a notoriously big market mover). In this case, yields moved lower because the auctions went well. In fact, much of the upward movement after the jobs report is thought to reflect traders being cautious ahead of these auctions (big financial firms are required to submit bids).

Bottom line: multiple variables are colliding at a rather pivotal moment for the interest rate landscape and we’re all but guaranteed to see more volatility soon. Moreover, if the variables align, the movement could be surprisingly big when compared to the recent range.