January has been a month marked by the market’s adjustment to a shift in the Fed policy outlook. This began right at the outset and resulted in higher rates and lower stock prices.

Why?

Last week’s newsletter goes into great detail on the matter. Revisit it HERE.

This week merely served to confirm what we already knew, namely that the Fed would not be making any policy changes this week, but that it would do nothing to push back on the expectation for policy changes at the next meeting.

Language was added to the announcement to suggest a rate hike at the next meeting, and there was no change to the pace of tapering (which will be concluded before the March Fed meeting). Last but not least, Powell said the Fed remains on track to begin trimming the balance sheet as early as the June Fed meeting–perfectly in line with our previous assumptions.

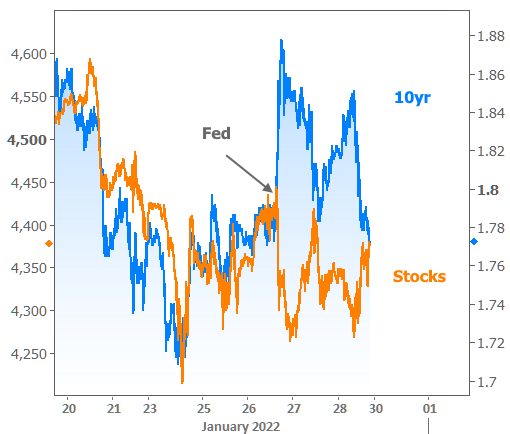

Stocks and bonds get a bit cranky when the Fed yanks the proverbial punch bowl away–even if they knew it was coming. Fortunately, they’d prepared quite well for this week in terms of trading levels. Sure, there was a bit of a volatile reaction at first, but the next 2 days of trading confirm that the Fed didn’t truly surprise the market (i.e. volatile trading with rates and stocks ultimately making it back near pre-Fed levels).

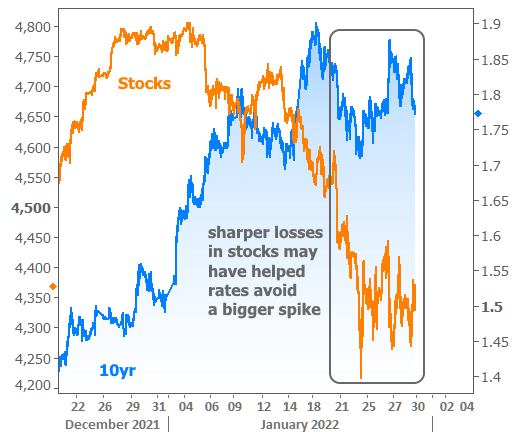

In the slightly bigger picture, we can see the damage that’s already been done (and the possibility that big stock losses have helped rates avoid bigger spikes).

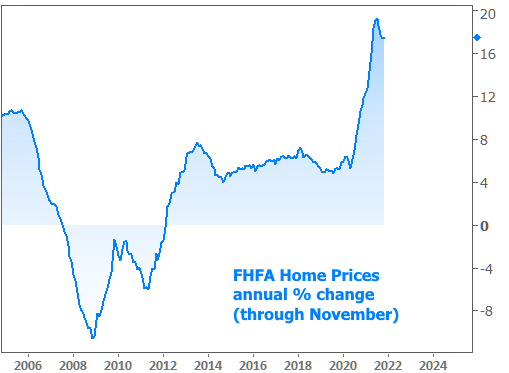

Despite the ultimately flat reaction to this week’s Fed news, some market participants are worried the impending Fed rate hikes will do something to tank the economy. This includes potential damage to home prices, stocks, and home sales. With those concerns in mind, and with the caveat that this data was only updated through November this week, here’s how home prices are doing:

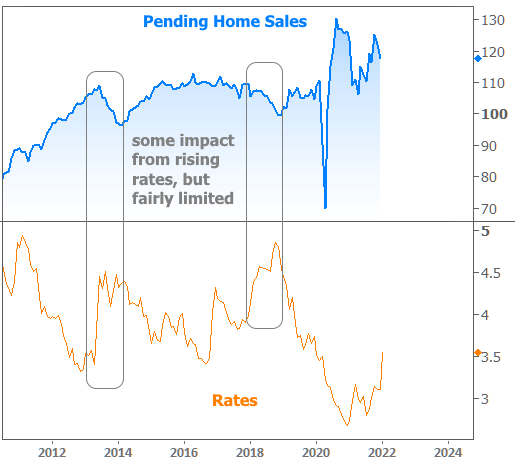

Here’s how Pending Home Sales are doing (with a bonus overlay of mortgage rates):

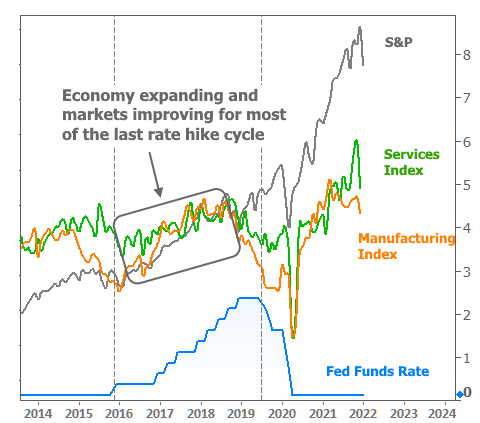

And here’s how stocks are doing (gray line). This chart also includes the most recent Fed rate hike cycle along with broad economic metrics for the manufacturing and services sectors. It shows that the economy and the market continued to expand for years as the Fed continued hiking rates.

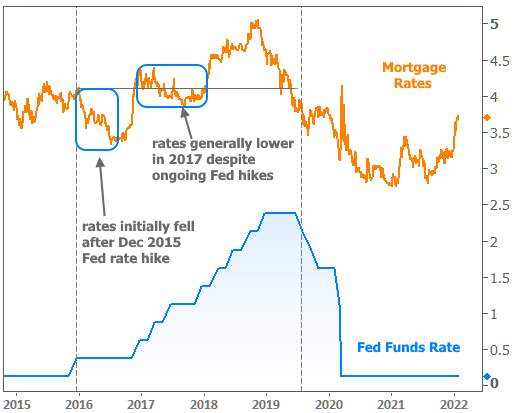

How about rates? If the Fed is hiking the Fed Funds Rate, what does that do to mortgages? The Fed only meets 8 times a year. Meanwhile, rates move every day. As such, rates do a great job of getting in position for Fed rate hikes before they happen. That’s one of the reasons mortgage rates were able to fall for roughly a year after the previous Fed lift-off.

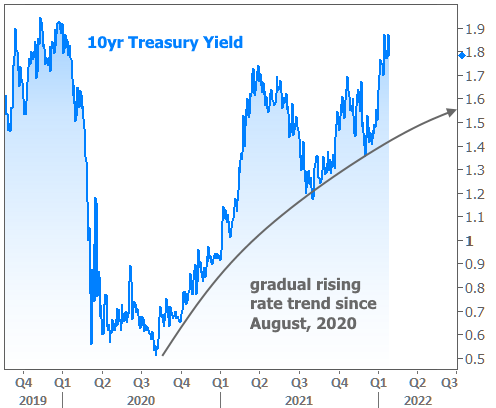

How have rates been doing in terms of getting ahead of Fed policy changes this time around? In a nutshell, it was even more of a given this time compared to 2015. We knew covid was taking an artificial bite out of the economy and that rates would move back up as the pandemic progressed. Unexpected speedbumps have slowed down the initial rising rate trend, but it began all the way back in August of 2020.

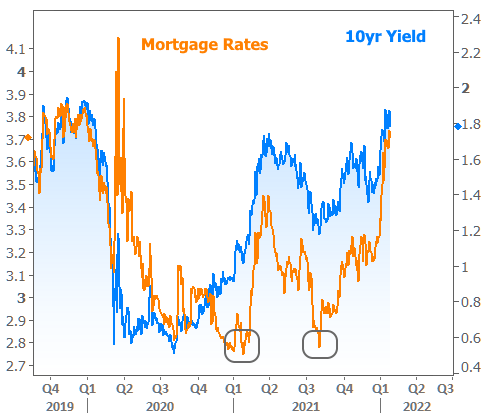

If it doesn’t FEEL like rates have been rising since August 2020, that may be because mortgage rates were a notable exception at times for a variety of reasons.

This apparently large rate spike is only now getting rates back into what had previously been the all-time low range.

If the rising rate environment of 2016-2018 is any guide, rates could indeed continue higher. That’s actually the baseline assumption for the average market participant, but it relies on continued progress against the pandemic, and an absence of other significant market shocks. Even if rates stick to the unfriendly trend, history suggests it won’t be the end of the world, and perhaps not even the end of the economic expansion (not any time soon anyway, but critics often fault the Fed for leaving rates too high for too long as economic contractions approach).