First-time Homebuyer Loans

MBOH has a few different options to help make it easier for prospective first-time buyers in Montana. Each of these loans differs in key ways, but one thing they have in common is a below-market interest rate. At the writing of this blog, MBOH’s rates are at 6-6.25% while market rates are nearly a percentage point higher! That can translate into significant savings and can also help overcome sticker shock. Check out our mortgage calculators to run some numbers and see how much you could save.

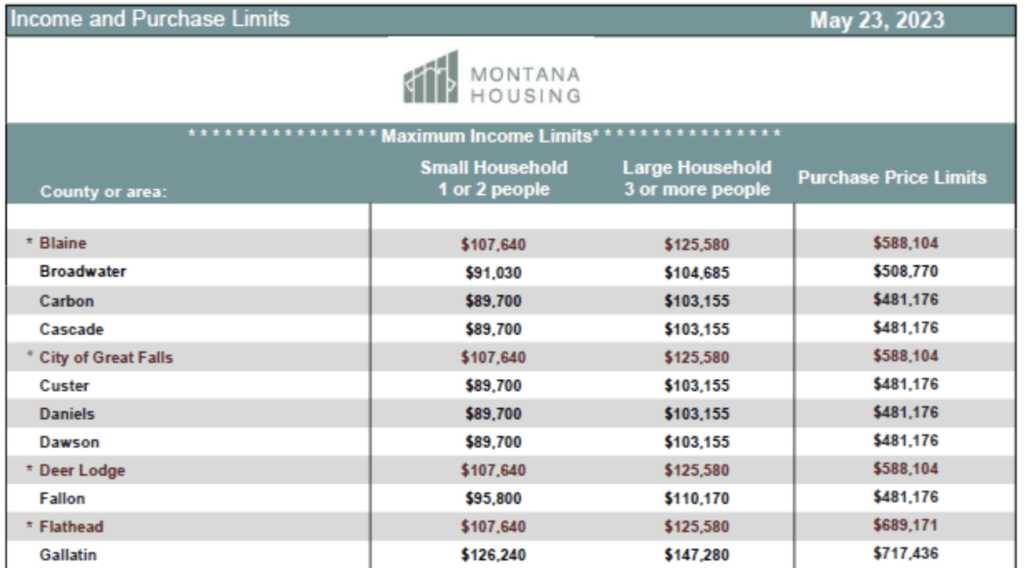

The next thing these first-time homebuyer loans have in common is income and purchase price limits. These limits are posted on the MBOH website and are updated periodically. A screenshot is pictured below. The limits vary based on county. These got a recent update and have made the program far more accessible to first-time homebuyers than in the past. Next, we’ll take a look at specific loan programs and how they differ.

First-time Homebuyer Loan – Regular Bond Program

This program is geared towards first-time homebuyers who don’t need down payment assistance. Suppose you qualify for an FHA, VA, RD, or HUD-184 loan. In that case, you can qualify for this loan program as long as you are purchasing a primary residence in Montana and are under the income and purchase price limits mentioned previously. There are a couple more key requirements as well:

- Business use limits: no more than 15% of the home can be used for business/trade purposes.

- First-time homebuyer or no prior homeownership for three years. Exceptions exist for targeted areas (red counties in the above photo), prior mobile homeowners, and qualified veterans.

First-time Homebuyer Loan – MBOH Plus 0% Down Deferred

This program is geared towards lower-income households and offers up to $15,000 in down payment assistance with 0% interest. The $15,000 is written as a second loan, but you don’t pay any interest on it and that money is paid back upon the sale or transfer of the home. Key requirements are the same as the above with some additional criteria:

- Income limits: maximum household income can’t exceed $80,000/year for 1-2 people or $90,000/year for 3+ people.

- A minimum of a $1000 borrower investment (contribution to the down payment) and can be in the form of gift funds from a parent or relative.

- Homebuyer education is required

- Minimum credit score of 620 and maximum debt-to-income ratio of 45%

First-time Homebuyer Loan – Bond Advantage

This program is similar to the above, but the key difference is that the $15,000 down payment assistance is paid back in the form of a 15-year term, fixed-rate second mortgage. Fortunately, the interest rate is the same as the rate on the first mortgage. This option is easier to qualify for than the 0% program above because it uses the county income limits (rather than the $80,000-90,000/year limit) and also has a higher debit-to-income ratio threshold.

Conclusion

That’s a lot to digest! You can see a summary of this information in a handy reference guide created by MBOH. Better yet, give us a call and we would be happy to go over everything in more detail and answer any questions you may have. It’s a must to talk to a knowledgeable loan officer because these programs, while helpful, can be tricky to navigate and secure. GoPrime Mortgage is officially a MBOH participating lender and so we can originate these mortgages and help get you into your first home!