Too frequently, media coverage suggests a Fed rate cut would coincide with lower mortgage rates and vice versa. But in practice it can be just the opposite! Let’s take a look at what the Fed is actually about to cut and how it might impact rates.

The Fed Funds Rate is set directly by the Federal Reserve. It’s the only rate people are talking about with respect to a “Fed rate cut.” The Fed Funds Rate applies to overnight loans between banks, credit unions and government sponsored enterprises. These loans aren’t covering shortfalls in the bank’s overall balance sheet (i.e. it’s not a payday loan), just shortfalls in the balances the banks hold at the Federal Reserve.

Nonetheless, the interest rate associated with these loans has profound effects on the financial market. Nothing does more to dictate the “cost of money” over the shortest time horizons. That cost radiates out to longer time horizons. Longer terms rates, like the 10yr Treasury Yield, are simply the market’s best guess at cash flows that will be generated by 10 years worth of the Fed’s overnight rate.

Needless to say, a lot can happen on any given day to make investors reassess short-term rate expectations over a 10 year time horizon. And while that reassessment is taking place, those investors might not see any near-term changes in store for short-term rates. When that happens, longer-term rates can move in one direction while short-term rates are holding steady (or even moving in the opposite direction).

This is the foundation of the discrepancy between the Fed Funds Rate and longer-term rates like those for mortgages. While it’s true that they each share a similar set of motivations, mortgage rates have to calculate and guess at how those motivations will evolve over time while the Fed Funds rate only has to worry about the here and now.

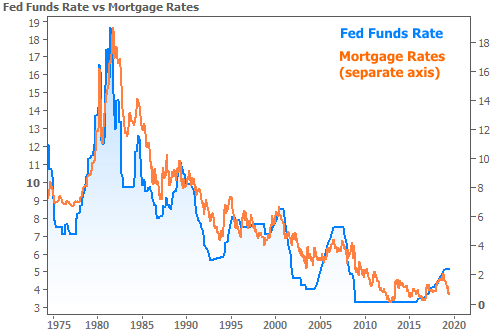

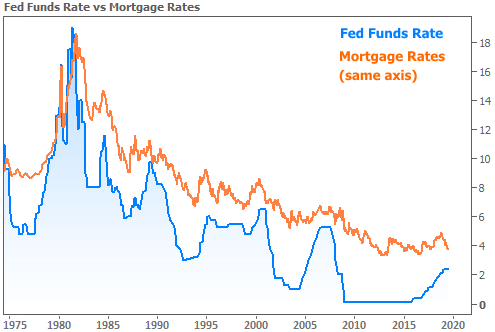

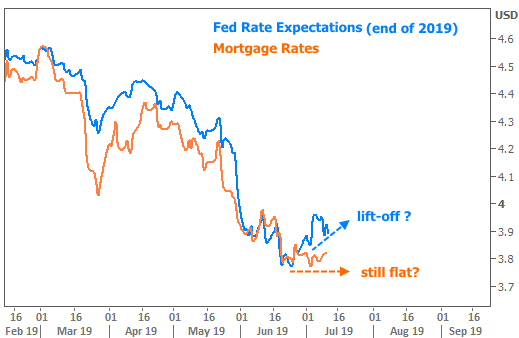

The “similar motivations” can be seen in the following charts which overlay mortgage rates and the Fed Funds rate. The first chart uses a different axis for each rate (so the lines can be visually closer together) while the two rates share the same axis in the second chart.

Yes, the blue and the orange lines look like they correlate in both these charts! So why does the title of this newsletter suggest a Fed rate cut could result in HIGHER rates?

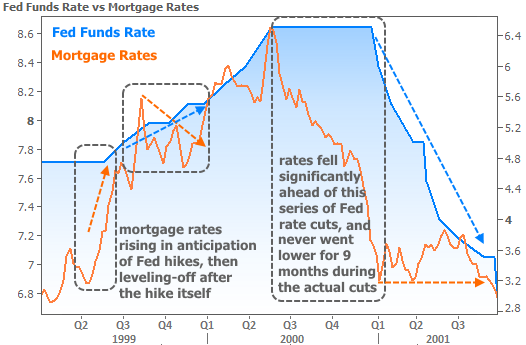

The answer is quite simple. The two rates ARE correlated if we’re zoomed out to a wide enough time horizon. But life and home-buying/refinancing decisions don’t always wait for big-picture correlations to pan out. If we zoom in to a narrower time horizon, we can see just how UN-correlated the Fed Funds Rate and mortgage rates can be. 1999-2001 provides a classic example:

The fact that long and short term rates can operate on a different set of motivations is only part of the issue. The compounding issue is that the Fed is typically like a battleship in a river when it comes to making changes in the trajectory of rates. Not only do they only meet 8 times a year to discuss potential rate changes, they also strive to avoid making changes too quickly and risk responding to a head-fake in the economy.

With that in mind, consider that the Fed may be on the proverbial fence about making a change at one meeting only to decide it might be too early to do so. That means it will be another 6 weeks before their next chance to make the change!

In that 6 weeks, the bond market may become even more convinced that it has the Fed’s number–especially if the Fed offered some clues in its policy announcement about potential rate cuts in the future. That’s essentially what you’re seeing in the chart above where mortgage rates seem to lead the Fed Funds Rate.

This might all seem a bit crazy. After all, why can’t the Fed just change rates today if it’s going to change them at the next meeting anyway? Again, they really don’t want to make changes too quickly. Past precedent suggests that does more harm than good. They also don’t want to look like they’re oblivious to the motivations pushing for a rate cut. Fortunately, there are ways of balancing those considerations.

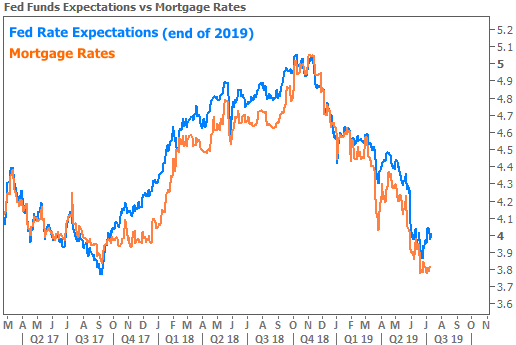

First off, the Fed can communicate its thoughts and intentions to prep markets for a potential change. That’s basically what happened in the June 19th Fed announcement and again this week in Fed Chair Powell’s congressional testimony. From there, markets can mathematically navigate around the slow-moving Fed is via something like the Fed Funds Futures market–a way for investors to hedge bets on the Fed Funds Rate at a certain point in the future. If we chart Fed Funds Futures versus mortgage rates, not only do we see the correlation we’d logically expect, we even see futures leading mortgage rates at times!

The high degree of correlation between these two lines means that we’ve already seen the drop in mortgage ratesassociated with the upcoming Fed rate cut. If we zoom in a bit, we might even conclude mortgage rates have a bit of catching up to do.

The takeaway is this: if Fed rate expectations for 2019 hold steady or increase, mortgage rates are more likely to move higher than lower, even though we could still see 2-3 rate cuts during that time.

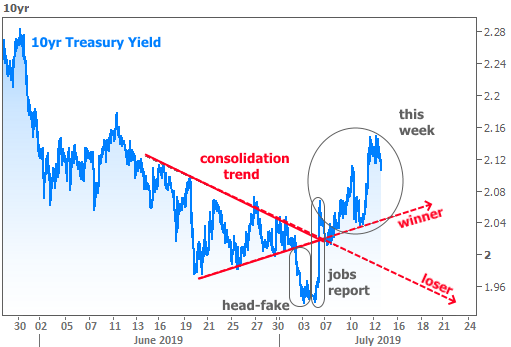

Is there some sense of urgency about potentially rising rates here? Yes! Not only would I suggest not being lulled into a false sense of security by the fact that the Fed is likely to cut rates at the end of this month, I would also call your attention to a potential shift in the trend based on the same chart we discussed last week.

The chart shows how 10yr Treasury yields (the best benchmark for momentum in longer-term rates, like mortgages) bounced back from the “head-fake” last Thursday and then spent the entirety of this week adhering to the upwardly sloped trend line (the “winner”) from last week.

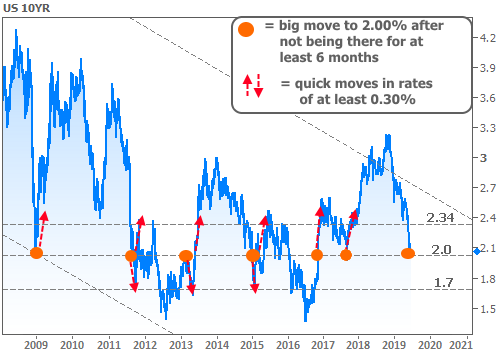

The second chart is from several weeks ago and it reminds us why a bounce at 2.00% would be troubling.

If it makes you feel any better, this week’s move in rates already got us a third of the way up to that ledge at 2.34%. Either way, it’s important to know that the path of rates has rapidly been getting back to economic fundamentals. That means the strength or weakness of incoming economic data will go a long way toward setting the tone for the next big move. If the data is resilient and/or stronger than expected, 2.34% would be a best-case ceiling.

That knife cuts both ways though. Weaker data would helprates avoid breaking much higher–if at all. And data that’s weak enough could give us another shot at 1.7% instead of (or shortly after) a visit to 2.34%.